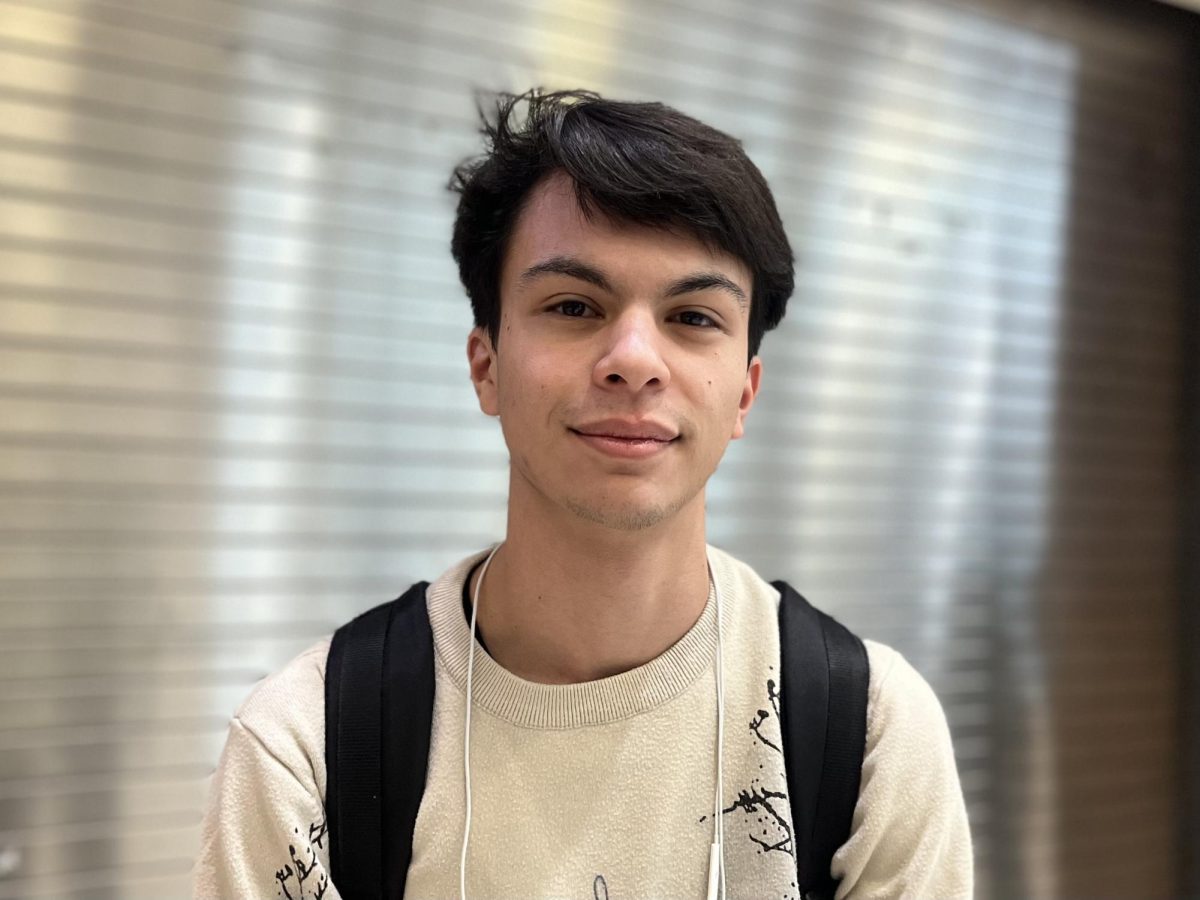

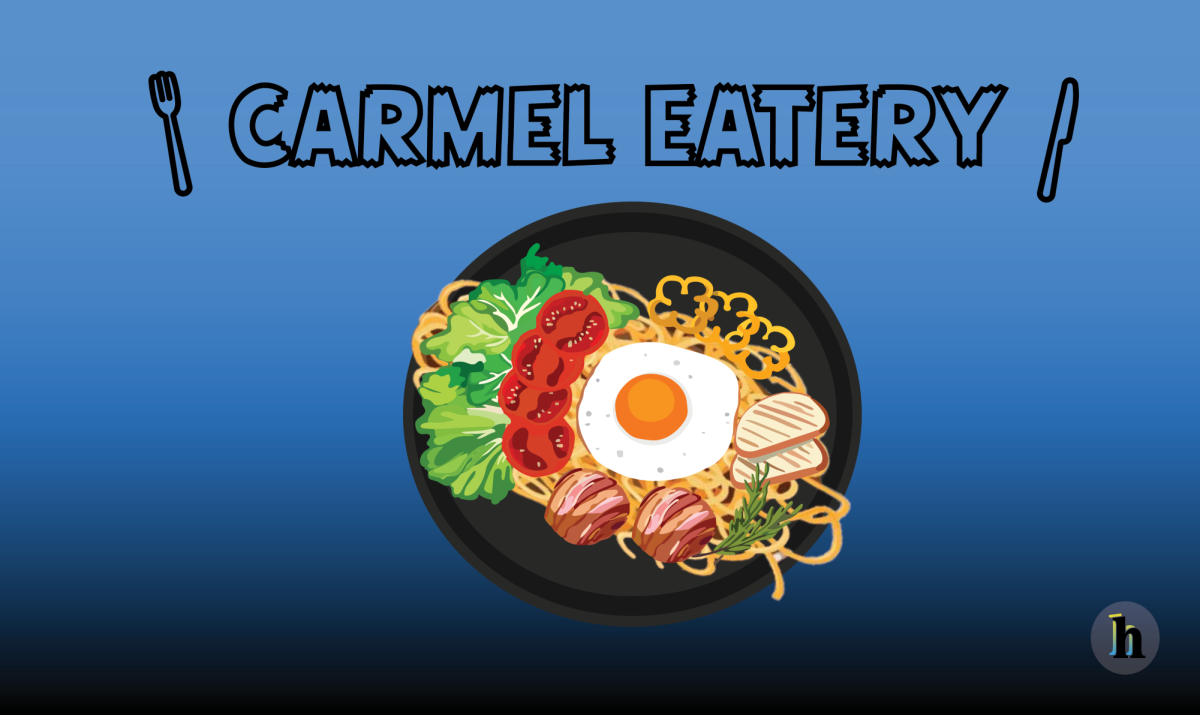

Like any typical high-school girl, junior [name obscured] likes to shop. With the start of each new season, as the weather changes, her wardrobe must be updated accordingly with the latest in fashionable clothes. Visiting the mall almost every week, [name obscured] said she likes to look around for anything that stands out.

“If I find something cute, I’ll buy it,” [name obscured] said. “I don’t like to wait a long time.”

[name obscured] is not alone. According to a 2011 Newsweek article by Sharon Begley, our generation especially spends impulsively due to our desire for instant pleasure as opposed to saving for a greater gain further down the road. And in a digital world where we can get almost anything at a moment’s notice, it comes as no surprise that when we want something, we want it now. Robin Pletcher said via email that she believes that extreme spenders may be trying to satisfy their need for a type of “reward” or seeking some kind of pleasure through shopping.

“They don’t have sense of impulse control to delay the gratification they get from that immediate satisfaction from the purchase they make,” she said.

Begley’s article states that psychologists and behavioral economists identified the personality trait that distinguish savers from spenders: not accurately seeing the consequences of not saving.

According to Pletcher, the consequences of impulsive spending include money loss, increase in debt and the lack of saving behaviors learned. She said people would develop a “get what I want now” mentality instead of learning how to wait for something.

Although a study described in Begley’s article supported the link between impulse control and academic performance, Pletcher disagrees.

“(There are) too many other factors involved to make a correlation here,” she said. “I don’t think that if someone is an impulsive shopper, they have to be impulsive in other areas of their life. I think the two are separate behaviors.”

However, Pletcher said she agrees with the idea that people spend impulsively for instant gratification but believes that it also depends on financial availability and what kind of gratification the person is seeking.

“Maybe he/she just wants praise or recognition,” Pletcher said. “They might not necessarily need ‘things’ to buy.”

Junior Catherine Onofrey said she thinks of shopping as a social activity. On the weekends, she said she meets with friends to go to different stores.

“It’s kind of a way to get to know someone because everyone likes shopping,” she said.

Although shopping is enjoyable, Onofrey and [name obscured] agree that one must be sure to carefully stay within one’s shopping budget.

[name obscured] said her parents give her an allowance that she cannot pass “It depends on how expensive it is,” she said. “You have to control and budget what you want.”

While Onofrey goes shopping three to four times a week, she only spends about $40 a month; she goes in order to be with friends rather than for actual items. On the other hand, [name obscured], who shops four times less frequently, spends about $100 a month.

In contrast to those who spend uncontrollably, some people thrive on saving coupons and finding the best prices. However, many don’t realize that often, buying cheap, unnecessary things is still a waste of money.

“Some people thrive on finding good deals,” Pletcher said. “They buy multiple items of something they might not even need just because it’s ‘free.’ Also, you have those who will go out at 4:00 am the day after Thanksgiving to get the

good deals.”

Pletcher suggests, “I would first say to buy what you can afford. Too many people are too much in debt, and they’ve let themselves get into trouble due to spending it.”

![Keep the New Gloves: Fighter Safety Is Non-Negotiable [opinion]](https://hilite.org/wp-content/uploads/2024/12/ufcglovescolumncover-1200x471.png)

![Review: “We Live in Time” leaves you wanting more [MUSE]](https://hilite.org/wp-content/uploads/2024/12/IMG_6358.jpg)

![Review: The premise of "Culinary Class Wars" is refreshingly unique and deserving of more attention [MUSE]](https://hilite.org/wp-content/uploads/2024/12/MUSE-class-wars-cover-2.png)

![Introducing: "The Muses Who Stole Christmas," a collection of reviews for you to follow through winter [MUSE]](https://hilite.org/wp-content/uploads/2024/12/winter-muse-4.gif)

![Review: "Meet Me Next Christmas" is a cheesy and predictable watch, but it was worth every minute [MUSE]](https://hilite.org/wp-content/uploads/2024/11/AAAAQVfRG2gwEuLhXTGm3856HuX2MTNs31Ok7fGgIVCoZbyeugVs1F4DZs-DgP0XadTDrnXHlbQo4DerjRXand9H1JKPM06cENmLl2RsINud2DMqIHzpXFS2n4zOkL3dr5m5i0nIVb3Cu3ataT_W2zGeDAJNd_E-1200x884.jpg)

![Review: "Gilmore Girls", the perfect fall show [MUSE]](https://hilite.org/wp-content/uploads/2024/11/gilmore-girls.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)

![SERIOUS SHOPPER: [name obscured] browses through racks of purses, trying to find the perfect one. [name obscured] said she often goes shopping and instantly buys whatever she likes. MIKAELA GEORGE / PHOTO](https://hilite.org/wp-content/uploads/2011/12/w.george.shopping.12.12.3.jpg)