Local school chapter of national organization to help with process of ‘micro-lending’

By Beverly Jenkins

<[email protected]>

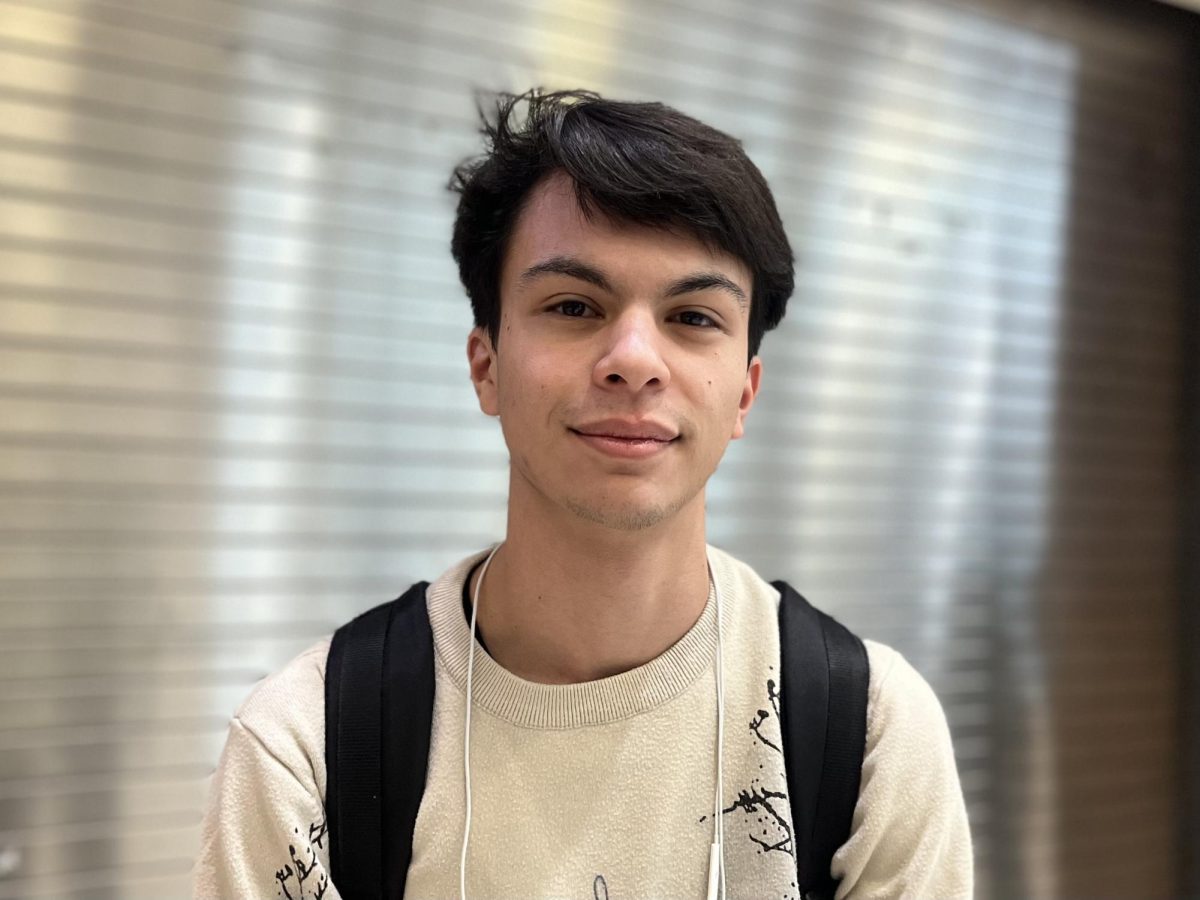

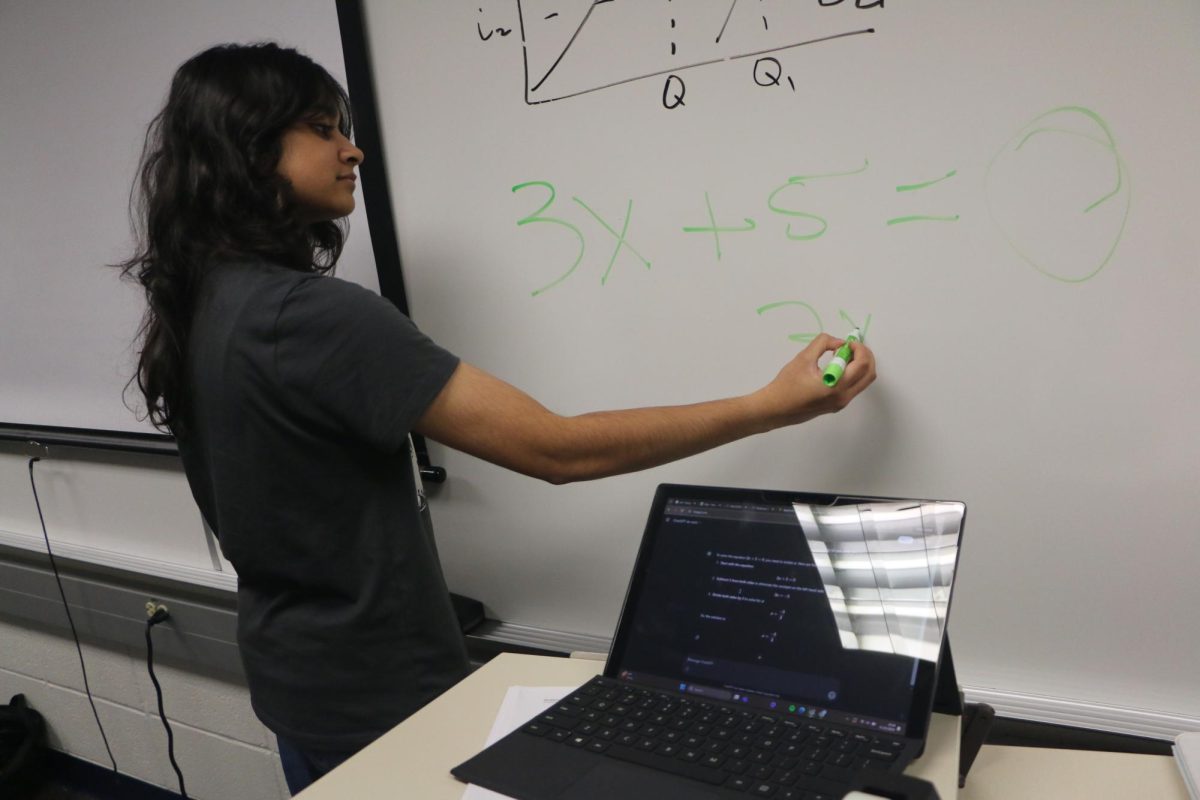

A few weeks ago, sophomores Aneesha Kamath and Caroline Stephens became co-presidents of a club that will bring a micro-lending organization known as Kiva to students here on a much more personal level. They have done so by creating the Kiva Club, which according to Stephens, will both promote and fundraise for the organization.

“We heard from (Kamath’s) mother that other schools were lending to Kiva,” Stephens said, “and we thought it was a great idea.”

In 2005, the world’s first person-to-person micro-lending Web site launched under the domain name kiva.org. Since then, the organization has been working hard to alleviate poverty worldwide, though its concentration is on third-world countries. In that time, Kiva has financed entrepreneurs around the world with nearly $65 million in micro-loans.

What makes the Kiva organization different from any other is how it helps people in developing countries. Instead of donating like other organizations or getting large loans from banks that charge high interest, Kiva operates using micro-loans.

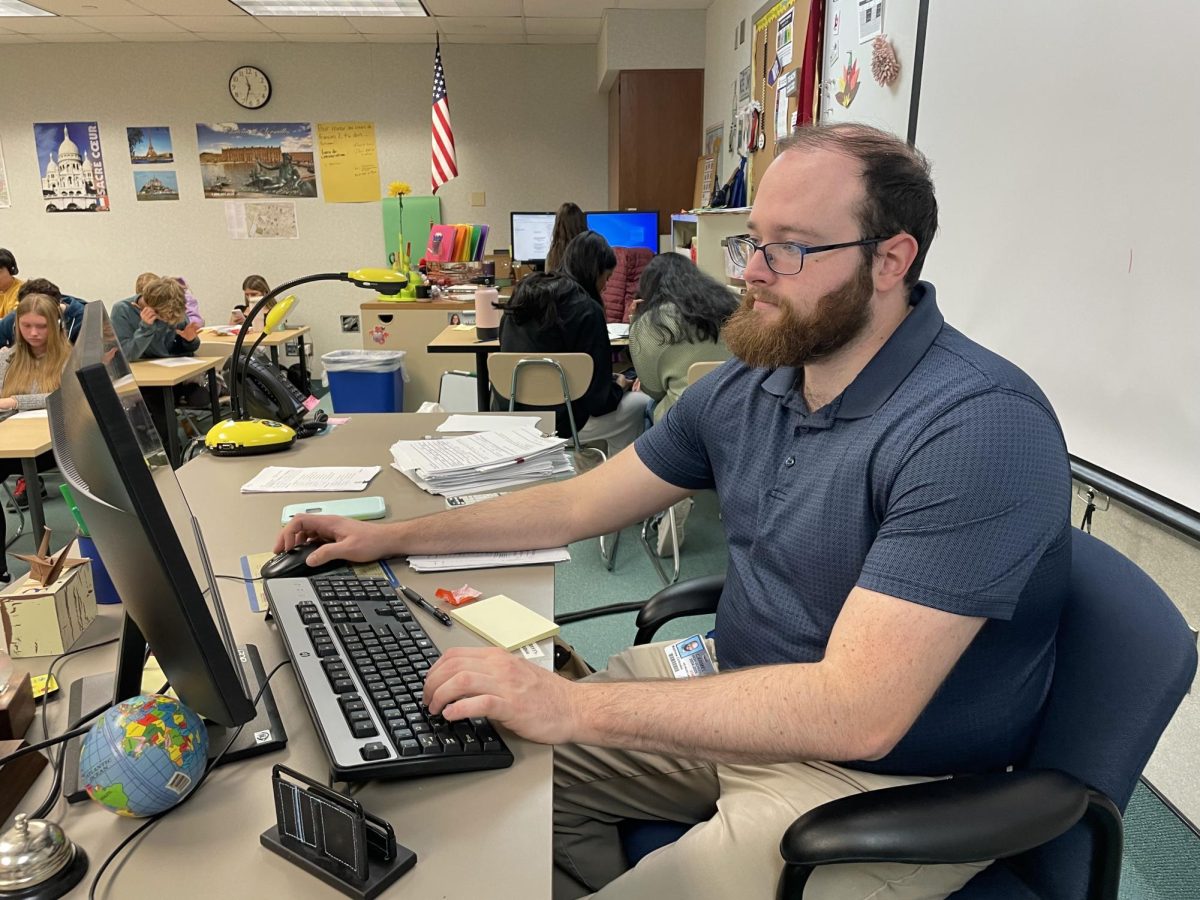

Economics teacher Dan Bates said, “It’s the principle of giving a man a fish for a day or teaching him to fish for a lifetime. All giving someone a handout does is teach them how to receive, but as little as a $100 loan can help someone get on their feet.”

What Kiva does not make explicitly clear, according to Stephens, is that someone who gives through the Kiva organization is technically donating.

“You won’t get your money back,” Stephens said. “As soon as the person you’ve lent to pays you back, you give that same amount or more to another person in need, and it goes from person to person; it’s an endless cycle of just a little bit of money.”

According to the Web site, donors may pull their funds at any time, but hopes that the money they donate will continue to circulate around the world.

The organization has gained thousands of supporters and raised millions of dollars, but Kiva’s popularity perplexes those who do not understand the specifics of the club. How does Kiva thrive, and why would someone sign up for Kiva instead of getting a loan from a bank?

The first point Bates made was those involved are not trying to make money off of the organization, as micro-lending typically charges very little, if any, interest. Also, the idea behind microlending is to help the impoverished, especially impoverished entrepreneurs trying to get on their feet. Otherwise, microlending would be no different from a bank, which does very little to help those in actual need of a loan.

“Banks aren’t out to help people, they’re out to make money,” Bates said. “(Banks don’t usually help) the people who actually need it. They lend money to people who don’t need money because they trust that those people can pay it back. People who do need the money are considered a risk.”

Another major reason for Kiva’s success is the fact that those who donate are not required to fund a great deal of money, and the money donated helps someone, is repaid and donated again to another person in need.

The Web site allows a lender to lend as little as $25 to as much as someone’s entire requested loan, which usually ranges from $800 to $1,200, because in developing countries, that’s all a person usually needs at one time. (Although Kiva members can request another loan after the first has been repaid.)

Although the Kiva Club here is just in the groundwork phases (club officers were elected at the last and only meeting thus far), the club has already drawn in quite a few members who have already established plans to fundraise including a booth for the annual Houndstock event.

As for fundraisers, Stephens said, “We also want to sell flowers before prom so someone can ask their date and host a few bake sales.”

In addition, members also bring in monthly dues of $5 that will go toward helping sponsor a Kiva member in need, who, according to Stephens will be decided by members in one of the future meetings.

One of the problems the club does face, however, is how that money will be transported to the organization. Stephens and Kamath both said the school is not willing to grant the club a PayPal account which is the dominant method the site uses other than credit cards (which if used would make the club officially not school-sponsored).

“We’re still trying to see if the school might grant us an account, but we’re also going to see if we could mail checks to Kiva instead,” Stephens said of the options they are left with.

In the meantime, the club is not stopping its goal to raise as much money as possible while simultaneously focusing on how it will be transferred.

“It doesn’t take much,” Stephens said. “All it takes is one dollar, bringing cookies for a bake sale, and you can dramatically affect someone’s life.”

—

ABOUT KIVA

- First organization that allows person-to-person microfinancing

- Inspired by child sponsorships

- People may donate as little as $25 toward business owners using their credit cards or PayPal

- Entrepreneurs repay loans in as little as 6 to 12 months

- Kiva’s partners also provide training and other assistance to maximize the entrepreneur’s chances of success

- After the loan is repaid, people may choose to re-donate that money toward another entrepreneur, pay for administrative costs or withdraw their donation

KIVA.ORG / SOURCE

![Keep the New Gloves: Fighter Safety Is Non-Negotiable [opinion]](https://hilite.org/wp-content/uploads/2024/12/ufcglovescolumncover-1200x471.png)

![Review: “We Live in Time” leaves you wanting more [MUSE]](https://hilite.org/wp-content/uploads/2024/12/IMG_6358.jpg)

![Review: The premise of "Culinary Class Wars" is refreshingly unique and deserving of more attention [MUSE]](https://hilite.org/wp-content/uploads/2024/12/MUSE-class-wars-cover-2.png)

![Introducing: "The Muses Who Stole Christmas," a collection of reviews for you to follow through winter [MUSE]](https://hilite.org/wp-content/uploads/2024/12/winter-muse-4.gif)

![Review: "Meet Me Next Christmas" is a cheesy and predictable watch, but it was worth every minute [MUSE]](https://hilite.org/wp-content/uploads/2024/11/AAAAQVfRG2gwEuLhXTGm3856HuX2MTNs31Ok7fGgIVCoZbyeugVs1F4DZs-DgP0XadTDrnXHlbQo4DerjRXand9H1JKPM06cENmLl2RsINud2DMqIHzpXFS2n4zOkL3dr5m5i0nIVb3Cu3ataT_W2zGeDAJNd_E-1200x884.jpg)

![Review: "Gilmore Girls", the perfect fall show [MUSE]](https://hilite.org/wp-content/uploads/2024/11/gilmore-girls.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)