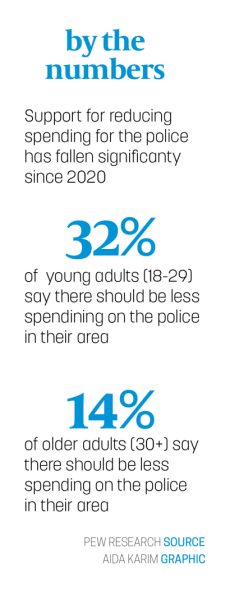

Mayor Sue Finkam’s administration plans to allocate a considerably large amount of tax money to the city’s police department on par with a state-wide trend. The funding would be coming out of the general fund, which is the city’ main checking account. They are also proposing a $25 annual surcharge on vehicles in 2025. The proceeds of the wheel tax will go toward road improvements.

In relation to the increase of funding to the police department, Finkam said, “First and foremost, public safety is the core aspect of what a city should provide its residents. Because of the number of personnel we need, that is often a big part of the budget. Every city and town looks to make sure they have strong public safety. Public safety salaries have escalated quite a bit in the past couple of years. And so most cities are struggling with how they fund these increases in public safety.”

“We made the decision to increase our pay considerably for public safety in order to retain what we think are the best and brightest in the state of Indiana,” She added. “Other cities are looking to do the same because there’s a shortage of police officers and firefighters as compared to just four years ago. Every city (in Indiana) is looking to find more money to fund public safety.”

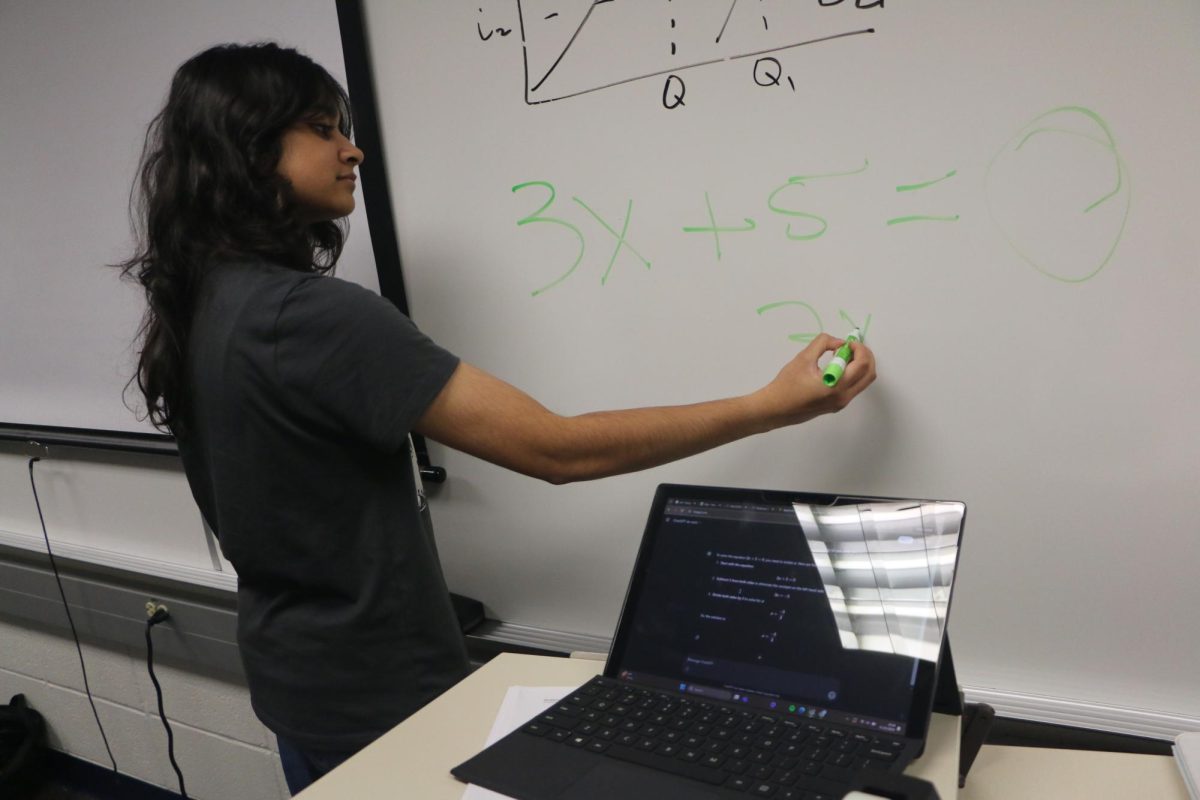

But not everyone is on board with these changes. Senior Rabya Moshin said, “Carmel is one of the safest cities in Indiana, I feel very safe in Carmel. I believe we already have ‘the best of the best.’ There could be other ways to increase their salary.”

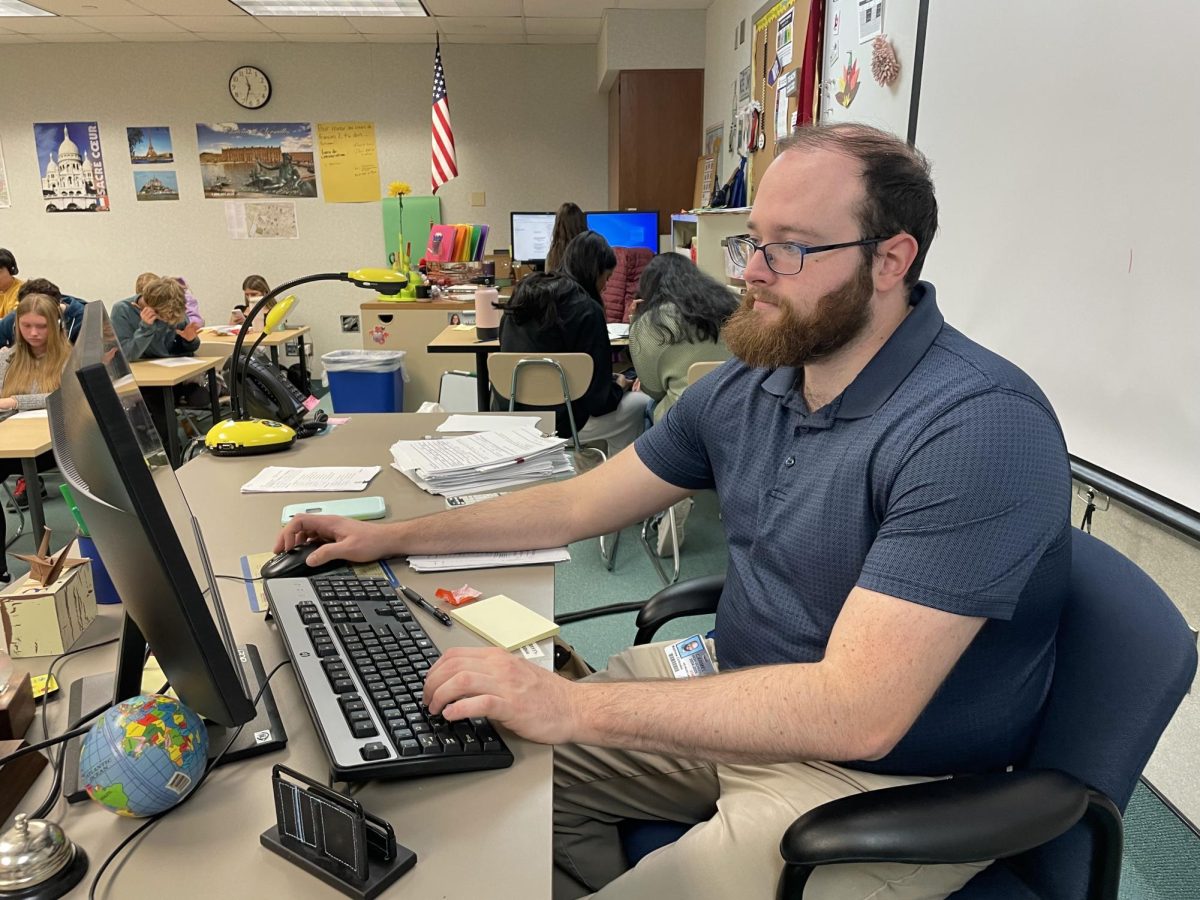

Microeconomics teacher Chris Ginet said, “Carmel is trying to get the people they currently have employed in the police department to stay and to decrease the turnover rate.”

“They’re really trying to stop people from leaving by increasing their salaries, so current officers don’t have the incentive to jump to a different police force just to earn a little bit more.” Ginet said. “The other big thing they’re funding in the proposed budget is the upkeep of 41 new vehicles. A lot of money would be going towards funding those new vehicles.”

Finkam explained what the younger generation prioritizes in terms of political values.

“I think our younger generation is more focused on taking care of our environment and outdoor recreation.” She said. “Our schools are more diverse than our community, so I think our younger generation is perhaps a little more comfortable with and supportive of a highly diverse community, but that’s not always consistent either; we’re talking generalities.”

Moshin said, “Carmel has a good recycling and trash system.” But she thinks that we can do better than that.

“We can definitely be a cleaner (energy) community as well. Investing in environmentally friendly infrastructure or more programs to help better the community would be much more rewarding,” she said.

Another aspect of the 2025 budget for government spending is the new surcharge on vehicles or wheel tax. The revenue generated from this tax will go toward road improvements. Neighboring cities in Hamiliton county, such as Fishers and Noblesville, have been following through with similar surcharges for road improvements as well.

Ginet said, “The city of Carmel would authorize the BMV to collect this tax on their behalf.”

“When you go to register your car every year, you have to pay a registration fee,” he said. “The city of Carmel estimated that they could generate $3.6 million a year that they would use to fund different things.”

According to Finkam, she met with Rep. Jim Pressel on Oct. 14 in Laporte. Pressel is one of the key legislators involved in road funding from Indiana.

“And he, like several other people I’ve talked to, said, ‘The state of Indiana gave cities and towns the ability to enact surcharges and wheel tax to gain revenue and we want to see them use it,” She said. “We don’t want to have cities and towns coming to the state asking for more road funding when we have the ability to generate more funds right here locally.”

Finkam described the motivation for creating the wheel tax. She said in the last couple of years, the cost to repave and maintain roads has gone up 30% to 40% because of inflation in gas cost because the components of gasoline are a big component of asphalt, labor and just overall inflation that has reduced the ability for the city to maintain its roads.

“The other reason we’re doing this is we use what’s called motor vehicle highway funds, which I said earlier is funded by gas tax,” She said. “As more electric cars hit the road, less gas is bought and less funds are available to local communities for their road funding. Similarly, because gas tax is a percentage of what is sold at the pump when gas prices go down, the less gas is bought, and the less tax revenue is available.”

Finkam said she wanted to emphasize how important feedback is from younger generations because she said they’re going to end up inheriting this community someday to run.

“I (want to) highly encourage anyone who’s got a concern or a question to reach out so that we can address it.” She said.

“Every single one of us elected me, the city council, the clerk and the judge, all have email. We welcome any feedback from our teens and our younger members of our community. We welcome that at any time. (We’re) always open to feedback and questions.”

![Keep the New Gloves: Fighter Safety Is Non-Negotiable [opinion]](https://hilite.org/wp-content/uploads/2024/12/ufcglovescolumncover-1200x471.png)

![Review: “We Live in Time” leaves you wanting more [MUSE]](https://hilite.org/wp-content/uploads/2024/12/IMG_6358.jpg)

![Review: The premise of "Culinary Class Wars" is refreshingly unique and deserving of more attention [MUSE]](https://hilite.org/wp-content/uploads/2024/12/MUSE-class-wars-cover-2.png)

![Introducing: "The Muses Who Stole Christmas," a collection of reviews for you to follow through winter [MUSE]](https://hilite.org/wp-content/uploads/2024/12/winter-muse-4.gif)

![Review: "Meet Me Next Christmas" is a cheesy and predictable watch, but it was worth every minute [MUSE]](https://hilite.org/wp-content/uploads/2024/11/AAAAQVfRG2gwEuLhXTGm3856HuX2MTNs31Ok7fGgIVCoZbyeugVs1F4DZs-DgP0XadTDrnXHlbQo4DerjRXand9H1JKPM06cENmLl2RsINud2DMqIHzpXFS2n4zOkL3dr5m5i0nIVb3Cu3ataT_W2zGeDAJNd_E-1200x884.jpg)

![Review: "Gilmore Girls", the perfect fall show [MUSE]](https://hilite.org/wp-content/uploads/2024/11/gilmore-girls.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)