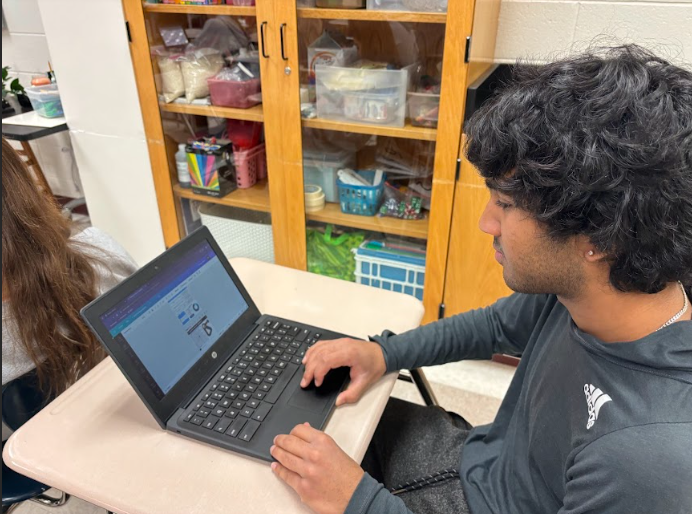

Although senior Carter Grove buys the necessities from brick and mortar businesses, he only has to turn to his computer screen for everything else. He purchases many items online, ranging from books to RC helicopters, on the online retailer Amazon about twice a month. Grove said he prefers to shop on Amazon because it offers a variety of items, which means he doesn’t have to run between different stores. According to Grove, Amazon’s biggest asset is its ability to offer lower prices than those of brick and mortar businesses.

However, starting in 2014 for Indiana residents, a 7 percent sales tax will increase the cost of Amazon purchases. Previously, since Amazon didn’t have a physical presence in Indiana, it didn’t have to collect sales tax from customers. Simon Property Group, an Indianapolis-based shopping mall owner, filed a lawsuit against the state because it said online retailers have an unfair price advantage. According to the State Budget Agency, the amount of uncollected online sales tax is estimated to be $75 million, but according to Sen. Luke Kenley, this number could actually climb up to $250 million.

Business department chair Debbie Lesjak said, “Well, I think if you are comparing an item that you can buy at a local store, and that you’re comparing an online item, (students) might’ve been more persuaded to buy from Amazon previously because you would have not had to pay the tax, which at 7 percent can amount to quite a bit of difference. Now, though, with Amazon having to pay taxes, then it’s kind of going to make it so that you’re more likely to buy at a more local establishment.”

Business department chair Debbie Lesjak said, “Well, I think if you are comparing an item that you can buy at a local store, and that you’re comparing an online item, (students) might’ve been more persuaded to buy from Amazon previously because you would have not had to pay the tax, which at 7 percent can amount to quite a bit of difference. Now, though, with Amazon having to pay taxes, then it’s kind of going to make it so that you’re more likely to buy at a more local establishment.”

Grove said the Indiana sales tax won’t stop him from using Amazon. However, he said he would stop using Amazon if it made its products more expensive because he only buys products whenever he has extra spending money. According to Lesjak, Amazon has more leeway on its prices because it is a large retailer like Wal-Mart; Amazon buys in a much larger bulk than smaller stores and can therefore offer lower prices.

Although Amazon shoppers in Indiana don’t have to pay a sales tax yet, they must add shipping and handling to their purchases, which includes the highest applicable per-shipping cost and all per-item costs. Once the sales tax is applied in 2014, the combined cost of the item, shipping and sales tax can make local stores more attractive to customers in terms of price.

According to Lesjak, brick and mortar retailers have the advantage of allowing customers to hold and manipulate products before buying them. However, Grove said price consideration is the biggest factor in his shopping decisions, and shipping doesn’t affect him because he usually doesn’t pay for it. Grove signed up for a free six-month trial for Amazon Prime, whose members receive free two-day shipping.

According to Gov. Mitch Daniels, Indiana is asking Congress to require a state sales tax for all online retailers. Besides Amazon, Grove uses online electronics retailer Newegg, and he has also bought one item from eBay, online shopping and auctioning site. Stacy Lu, founder and creator of Illume Apparel, sells clothing items such as graphic T-shirts and crewnecks through the online distribution system Big Cartel.

“Mostly I sell online because selling in stores is more expensive. You have to pay rent fees to sell in stores, and it’s hard to find a store that will be accepting of a teenager who is selling clothes,” Lu said. “The internet also allows for a wider market for someone to sell something, and from a business perspective, it allows for better sales.”

If Indiana imposes a sales tax on online retailers other than Amazon, Lu said the added amount has the potential to lessen her sales. However, many of Lu’s customers come from cities in California, New York and Texas. She said these customers wouldn’t care as much.

Lu said she thinks the sales tax could have positive results because of all the money that would be going to the government rather than to online stores, which could better benefit the state as a whole.

Lesjak said, “I think that as, you know, we look in the time where all states, they’re looking at their budgets, that they’re trying to gather as much revenue as possible. And so when you look at much money as Amazon sales equates to, it really is a lot that the state leaps on collected. So states are going to have to be more comfortable and their tax collections.”

!["Wicked" poster controversy sparks a debate about the importance of accuracy versus artistic freedom [opinion]](https://hilite.org/wp-content/uploads/2024/11/riva-perspective-cover-1200x471.jpg)

![Chilling or Childish? The downfall of modern horror movies [opinion]](https://hilite.org/wp-content/uploads/2024/10/adjusted-horror-cover-1200x471.jpg)

![“Uglies” is a call for change in the YA dystopian genre [opinion]](https://hilite.org/wp-content/uploads/2024/10/Perspectives-Cover-1200x471.jpg)

![Review: Indy Scream Park is a perfect level of spook to kickstart the Halloween season [MUSE]](https://hilite.org/wp-content/uploads/2024/11/IMG_1383.jpg)

![Review: “Saturday Night” is a chaotic and thrilling look at the origins of “Saturday Night Live” [MUSE]](https://hilite.org/wp-content/uploads/2024/10/snl-1200x800.jpg)

![Review: “Megalopolis” is a bold, bewildering mess [MUSE]](https://hilite.org/wp-content/uploads/2024/10/MV5BYTk3MjUzMGItYmU1NC00M2YyLThmNDMtNDI4NjkxNjgzMjQzXkEyXkFqcGdeQXRyYW5zY29kZS13b3JrZmxvdw@@._V1_-1200x675.jpg)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)