After a long and strenuous four years, senior Abby Leonard is ready to graduate CHS in the class of 2017. Although excited to attend Yale University this fall, Leonard said she had a small issue regarding her education there: financial aid.

Leonard said, “I had to file for a waiver to not include my non-custodial parent’s financial information (when determining the aid Yale would provide), which is a very lengthy, long process. If I get my waiver approved, my debt will probably be around $20,000, but if I don’t get that waiver, then it can be upwards of $40,000 or more.”

Given her current family situation, Leonard said she would have had to take a loan because the amount Yale University would have provided through financial aid was based on her family’s entire income. Leonard explained her parents are divorced and her father had decided to discontinue contributing child support once Leonard turned 18; thus, when estimating her family’s income and the amount she can pay, Yale should have only considered Leonard’s mother’s income.

“Yale (said) my mom has to pay a certain amount, which we can’t really pay because they are including my dad’s income, even though they technically shouldn’t be because he is not giving us any child support,” Leonard said.

With the large amount that remained, Leonard said she had to consider taking out a loan and finding the right provider. Since January, Navient Solutions, the largest servicer for student loans, has undergone several lawsuits with the Consumer Financial Protection Bureau (CFPB) and several state attorney generals for deceiving its customers by raising its loan repayment costs and violating collection processes, according to the New York Times.

With the large amount that remained, Leonard said she had to consider taking out a loan and finding the right provider. Since January, Navient Solutions, the largest servicer for student loans, has undergone several lawsuits with the Consumer Financial Protection Bureau (CFPB) and several state attorney generals for deceiving its customers by raising its loan repayment costs and violating collection processes, according to the New York Times.

Furthermore, according to Time Money, the loan company has already received 14,510 CFPB complaints since February of 2016, ranking it as the most loathed financial company in the United States. Students are now left with limited sources of money for tuition, struggle to find a loan and begin to question how exactly they are going to pay off their college education debts.

According to Robert Sommers, marketing associate at INvestEd, a local investment provider and educator, there is a two-step process to taking a loan for college: obtain a student or federal loan, then decide between the parent and/or private loan.

“When students look at (private loans), they need to shop. Most families don’t shop; they get a loan from one place and they’re good or they recognize a name, like Navient. It’s better for them to actually look, just as you would for when you travel. Find a lender that is going to work. Look for benefits the lender has,” Sommers said.

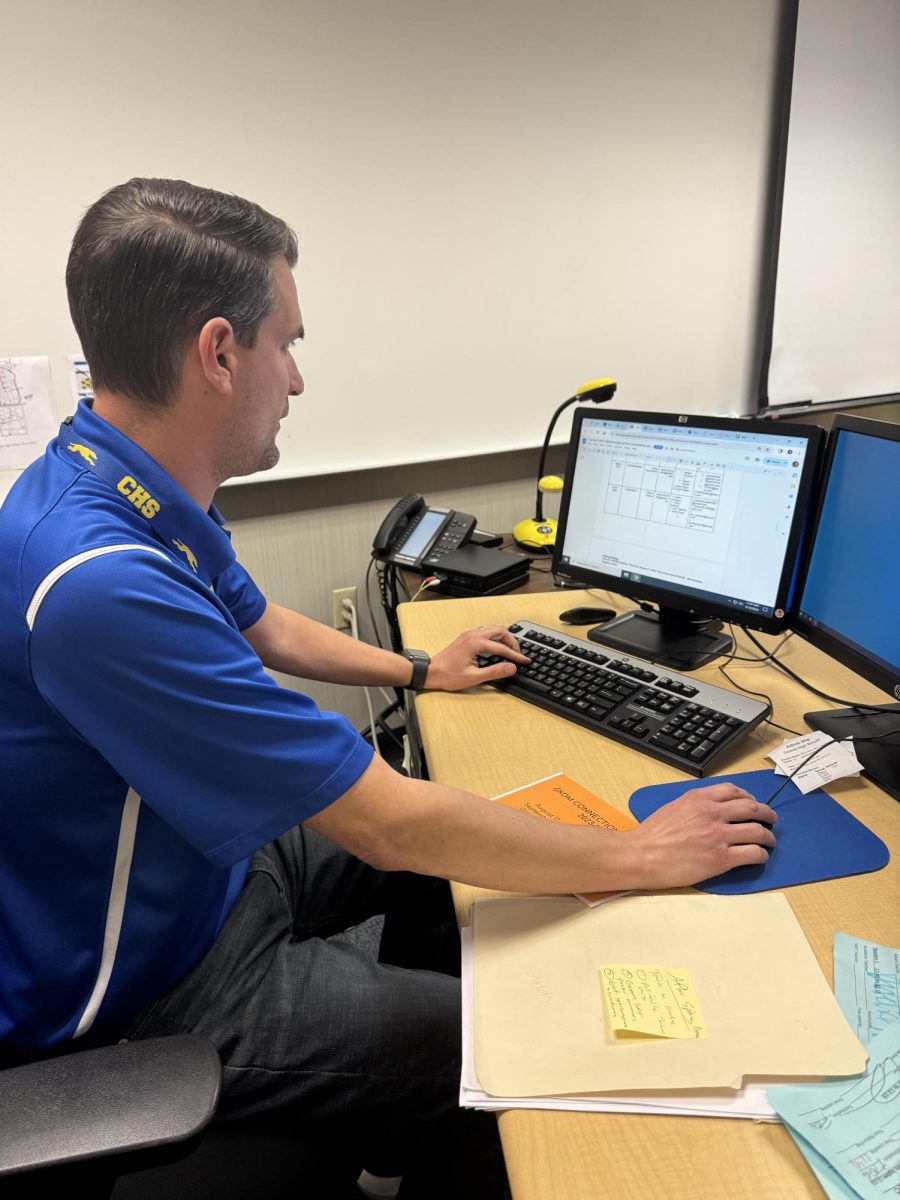

However, there are other ways to alleviate that remaining cost usually paid off by loans, according to Melinda Stephan, the college and career programming and resources coordinator at this school. She said there are two types of financial aid: merit-based aid given based upon one’s accomplishments, also known as scholarships, and need-based aid determined by income and need, the gap in between how much college costs and how much your family is expected to pay.

Stephan said, “Scholarships can make a difference in bringing the cost down because when we say the word ‘scholarship,’ we are usually talking about something that does not need to be paid back, as opposed to loans.”

Furthermore, Stephan said the financial aspect of going to college is one factor into the college decision process. While paying off college is one issue within a college education, she said it can be another issue in actually deciding which college to go to.

“Along the way, when we are talking about finding a fit, we are also talking about finding a financial fit. Early on, it’s important to just understand how financial aid works, how to start saving and where to get the information,” Stephan said.

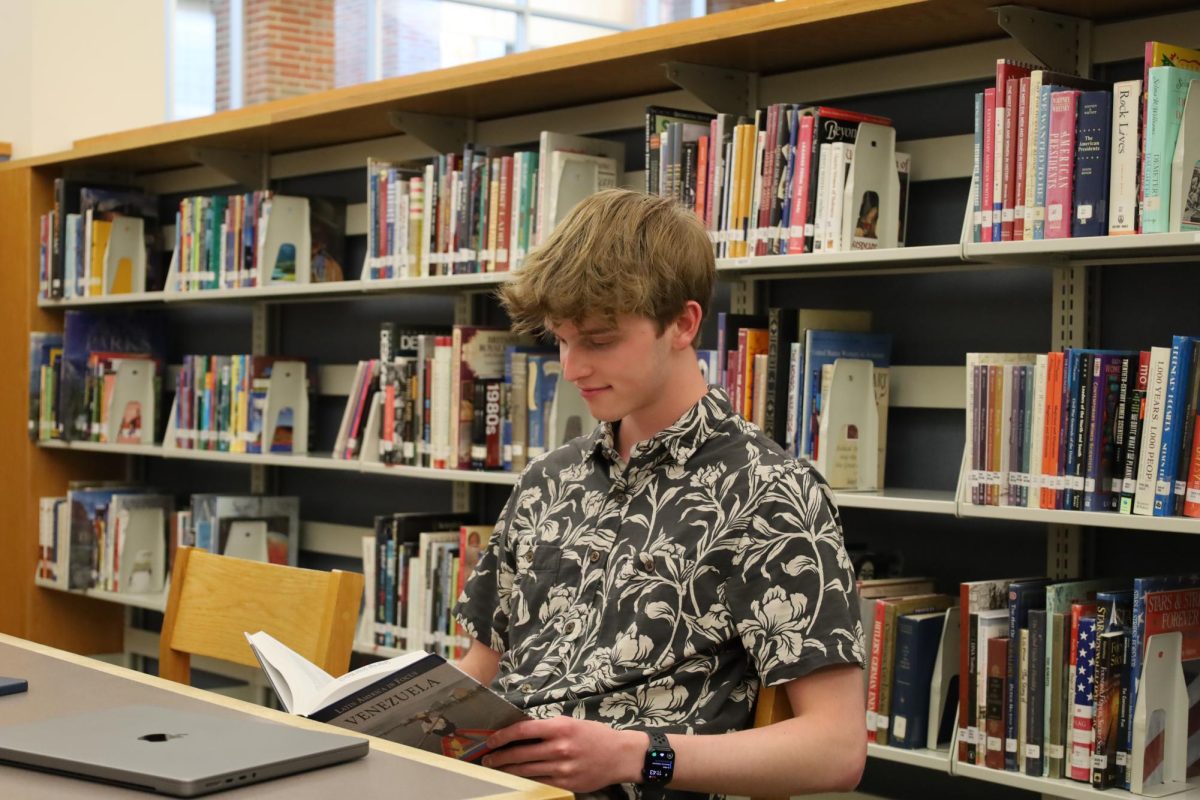

After approximately two months of waiting for the waiver to be accepted, Leonard said her waiver and financial aid, based solely upon her mother’s income, were approved, which was essentially a full-ride to Yale. However, she said she strongly recommends completing scholarship applications early.

“My tuition and all of my financial need to the state of Indiana is covered if I go to a state school by some kind of veteran association, because my mom is a veteran,” Leonard said. “I didn’t think scholarships were something I had to do because everything was going to be covered.”

![British royalty are American celebrities [opinion]](https://hilite.org/wp-content/uploads/2024/03/Screenshot-2024-03-24-1.44.57-PM.png)

![Chelsea Meng on her instagram-run bracelet shop [Biz Buzz]](https://hilite.org/wp-content/uploads/2024/04/IMG_2446-1200x838.jpg)

![Review: Quiet on Set: The Dark Side of Kids TV is the long awaited exposé of pedophilia within the children’s entertainment industry [MUSE]](https://hilite.org/wp-content/uploads/2024/04/unnamed.jpg)

![Review: “The Iron Claw” cannot get enough praise [MUSE]](https://hilite.org/wp-content/uploads/2024/04/unnamed.png)

![Review: “The Bear” sets an unbelievably high bar for future comedy shows [MUSE]](https://hilite.org/wp-content/uploads/2024/03/unnamed.png)

![Review: “Mysterious Lotus Casebook” is an amazing historical Chinese drama [MUSE]](https://hilite.org/wp-content/uploads/2024/03/0.webp)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: When I Fly Towards You, cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: Ladybug & Cat Noir: The Movie, departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: Hidden Love is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: Heartstopper is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)

![Review: Ladybug & Cat Noir: The Movie, departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster-221x300.jpg)

![Review: Next in Fashion season two survives changes, becomes a valuable pop culture artifact [MUSE]](https://hilite.org/wp-content/uploads/2023/03/Screen-Shot-2023-03-09-at-11.05.05-AM-300x214.png)

![Review: Is The Stormlight Archive worth it? [MUSE]](https://hilite.org/wp-content/uploads/2023/10/unnamed-1-184x300.png)