Year after year, a new batch of seniors at this school make decisions for their post-high school plans. With such a multitude of successors, one would think the margin of error created in the process would decrease each year. However, studies have shown this is not the case, particularly in financial areas. In 2009, the average college loan debt for a four-year degree was $24,000, and according to the Federal Reserve, outstanding student-loan debt totaled at $830 billion. This surpassed the credit-card debt of $826.5 billion. The problem has been a point of concern for everyone from students to Wall Street protesters to the federal government.

On Oct. 26, President Barack Obama announced his plan to accelerate an act passed by Congress that should help alleviate student loans in the long run. The measure, which is now scheduled to take effect in 2012 instead of its original premiere date of 2014, lowers the time it takes for debt to be forgiven from 25 years to 20. In addition, the maximum requirement of discretionary income students paid annually will be lowered from 15 percent to 10 percent. However, even if the measure does apply to current students here, these government handouts don’t make it okay to ring up a six-figure loan amount, and they certainly don’t mean that students can slack off with college payment decisions. It’s not the government’s responsibility to save students from debt; it’s the student’s responsibility to make smart enough choices to avoid crippling debt altogether.

With college loan debt affecting so many students nationwide, it is important for students to take steps now to educate themselves of the cost that will follow them through college and beyond. The price of the college a student attends should be equivalent to the value at which the education is placed. An Ivy League degree may be impressive, but it’s going to be the career, not the piece of paper, that pays off loans. Successful careers are created at different colleges throughout the nation, but that doesn’t mean students should pay any less attention to the colleges found within driving distance of Carmel. Occasionally the glamour of an out-of-state college can deceive students into thinking that the institution is more qualified than the options closer to home, even when the price tag is beyond their budget. Students should examine and utilize the resources available in their own vicinity, and not solely for the in-state tuition (although that’s a major plus). In the case of many fields of study, Indiana’s colleges offer degrees in exclusive, top-notch programs for less money. For those looking to make a fortune in the business world, for example, Indiana University offers a highly ranked undergraduate business program. Others going into engineering should take advantage of the wonderful opportunities offered at Purdue. Ball State boasts top programs in both architecture and education. All throughout Indiana are renowned technical schools. With so many beneficial choices in our own state, considering an Indiana-based college can help a student’s pocketbook and future.

College is a means, not an end, and paying for an education that won’t be able pay for itself in the long run is unwise. Choosing a college that will be most beneficial to a student’s lifestyle doesn’t mean choosing the one with the largest price tag. Often people mistake “essential” and “expensive” as synonyms, when, in reality, they couldn’t be more unrelated. It is excessive to commit to thousands of dollars in loans when there is another educational option that can give a student the same outcome for thousands of dollars less. In fact, some students may find it beneficial to choose not to attend a four-year college, opting instead to attend a two-year technical school or spending a year or two in the work force to earn more money before deciding on a course of action. Students should realize their ability to personalize their future.

The truth is, there are lots of options. And the key to choosing the right one, as is the case with all impactful decisions, is thought. Only students can be the judge of whether or not your post-gradation decision will be profitable. If picking a college, or deciding to opt out of college altogether, took less pre-planning than the outfit you’re wearing, then you might want to reevaluate your choice. As much as high schoolers hate to admit it, your plans after high school follow you for the rest of your life and should not be taken lightly.

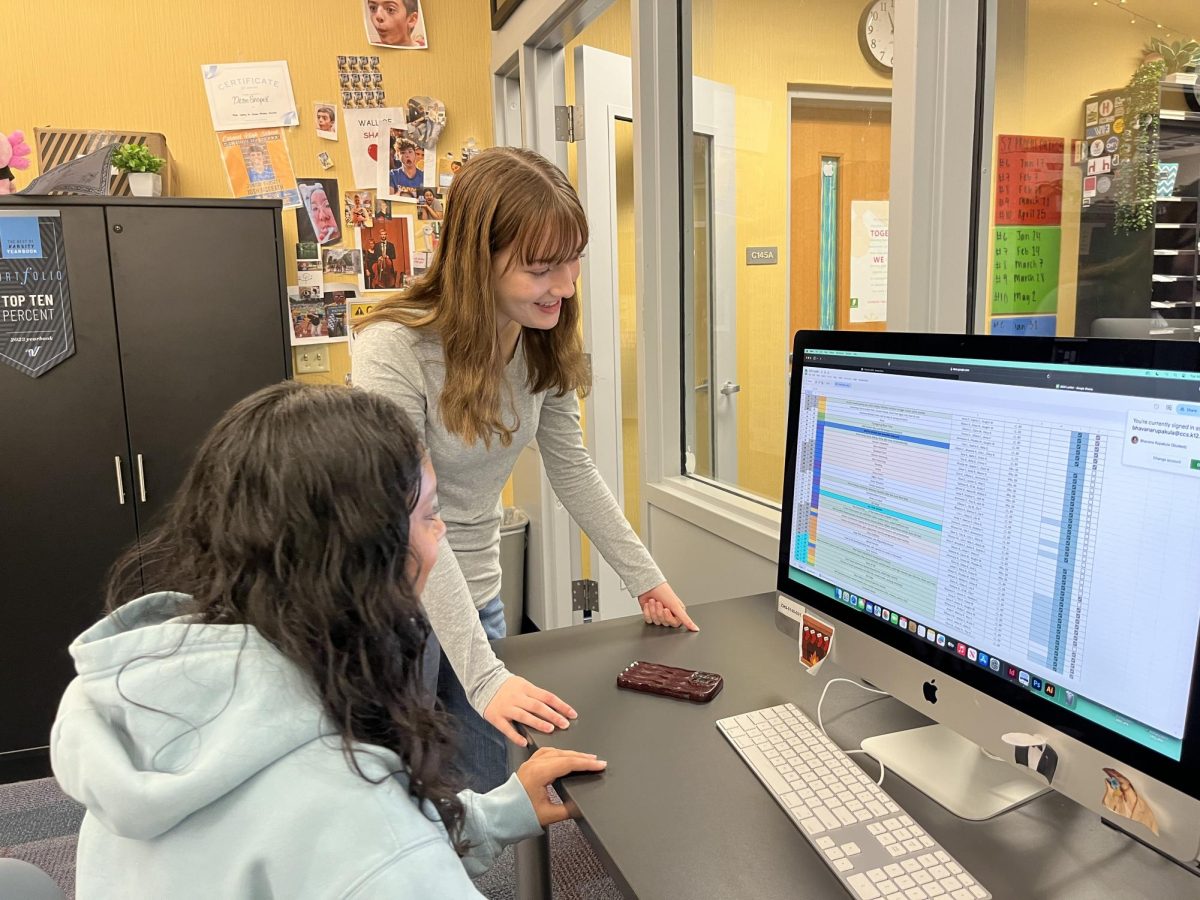

![Greyhound Connections has its own SSRT to make it easier for students to find them and ask for help. Junior Cora Shea, co-president of Greyhound Connections, said, “This event was a good representation of what [Greyhound Connections] does and helped everyone who attended be better at their role in Greyhound Connections.”](https://hilite.org/wp-content/uploads/2025/03/Screenshot-2025-03-19-at-10.36.39 PM-1200x902.png)

![AI in films like "The Brutalist" is convenient, but shouldn’t take priority [opinion]](https://hilite.org/wp-content/uploads/2025/02/catherine-cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)