While some of her friends have already received acceptance letters from the colleges they know they will attend next year, senior Katie Havard is still in full swing of the college application process. Three of the colleges she is considering—Washington University in St. Louis, the University of Miami and Cedarville University— have tuitions that amount to annual costs of $40,950, $38,917 and $29,642, respectively. For Havard, higher education is an expensive undertaking that requires thorough planning.

“Both my sister and I will be studying in college at the same time for at least the first two years,” Havard said. “My parents and I have made it a goal to graduate from college debt-free or carrying only a small debt. Having an older sister who went through this process before me definitely helps in terms of saving, but college costs can still be confusing because there are so many factors to keep track of, like tuition, housing, food and scholarships.”

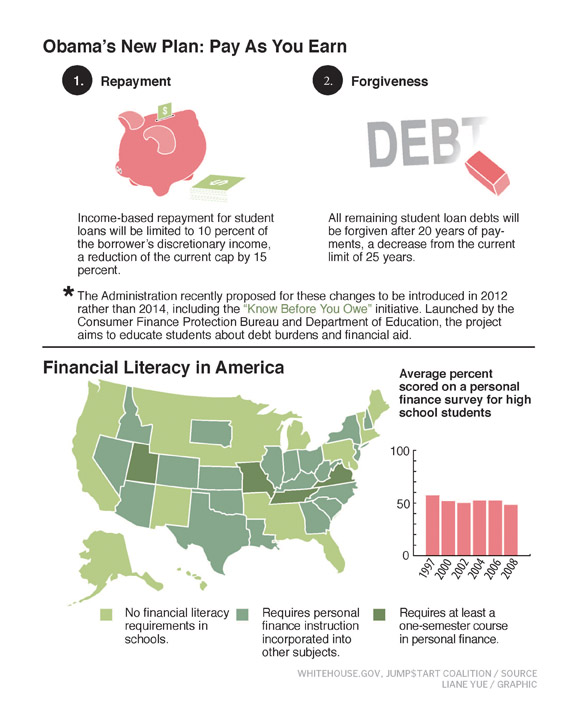

Students like Havard may benefit from some good news. Across the country, the pressure on college-bound students who seek the most affordable deals and the real cost of a college education may soon be alleviated. On Oct. 25, President Barack Obama made an executive order that will clarify the costs of college and accelerate a student loan assistance initiative. These changes will take effect in 2012, rather than 2014 as originally planned.

Students like Havard may benefit from some good news. Across the country, the pressure on college-bound students who seek the most affordable deals and the real cost of a college education may soon be alleviated. On Oct. 25, President Barack Obama made an executive order that will clarify the costs of college and accelerate a student loan assistance initiative. These changes will take effect in 2012, rather than 2014 as originally planned.

One component of the plan is the “Pay As You Earn” program, which will not only lower monthly student loan payments to 10 percent of discretionary incomes but also erase the debt after 20 years of payments. In addition, the Consumer Finance Protection Bureau and “Know Before You Owe” fact sheet will help clarify college costs and allow students to more easily compare the real costs of different college options, according to Obama’s plans. Around 1.6 million students may see their debt decrease by hundreds of dollars each month as they continue to attend college.

Harry Pettibone, college adviser at the College and Career Resource Center (CCRC), said, “It’s becoming increasingly important for students to pursue higher education so that they can lead a successful life and compete in the global economy.”

According to the Carmel High School profile, 85 percent of 2011 graduates enrolled in a four-year college, and 11 percent enrolled in a two-year college or trade school. With this large percentage of students pursuing a higher education path every year, accounting teacher Jill Noel said the need for students to be financially literate is even greater.

According to Noel, this prevailing attitude of financial nonchalance can be largely attributed to the fact that many students graduate high school without having taken a finance class. She said schools should introduce financial education to students as early as in elementary school, in which the basics can be taught.

In the past five years, several states have successfully made financial-literacy classes mandatory for graduation; however, Indiana is not one of them. Around that time, Noel had been a member of the curriculum committee, and a group of business individuals proposed that personal finance be a requirement for graduation in the state of Indiana. The U.S. Department of Education, however, had rejected the proposal.

“By the time they’re in high school,” Noel said, “(students) know how to do high-level mathematic calculations. Yet they still don’t know how to do some of the most basic financial procedures like opening and maintaining a checking account and understanding credit and insurance.”

Two courses that Noel recommends are personal finance and accounting, both of which she said would not only help in managing daily finances but also in pursuing a business major in college.

Havard, on the other hand, said she does not feel that finance courses should be required for students to graduate; however, she agrees they can be helpful and could be more strongly encouraged among many students who have not before considered taking a finance course.

“Obama’s plan,” Noel said, “may initially encourage students to go to colleges they hadn’t previously thought possible, but in the long run it’s extremely important that students have financial literacy. Those who don’t understand finance won’t be able to pay off their student loans, and the stigma of debt and lack of financial knowledge will affect not just their credit score but how they live the rest of their lives.”

But ultimately, according to Pettibone, the root of the college finance issue lies in college choice.

“The most expensive colleges don’t necessarily provide a better education than the in-state colleges,” he said. “The college you graduate from is a factor in finding a job, but in the end it’s about how you perform in college, no matter which one you go to. You can still establish yourself as a prime candidate for employment at a less expensive school.”

Havard said, “I think finding the college that fits you best and that provides quality education is far more important than the label.”

![AI in films like "The Brutalist" is convenient, but shouldn’t take priority [opinion]](https://hilite.org/wp-content/uploads/2025/02/catherine-cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)