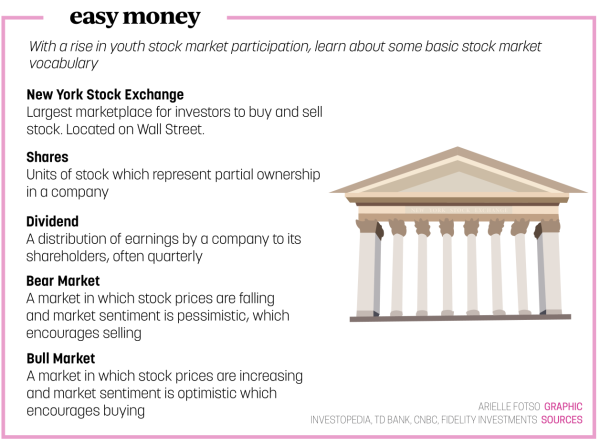

In recent years, the stock market has experienced a remarkable surge in youth participation, a phenomenon that reflects a significant cultural shift in how young people engage with investing and financial literacy. With the advent of user-friendly trading platforms like Robinhood, Acorns and Webull, investing is no longer seen as a realm exclusive to professionals. Today’s youth are eager to learn about financial markets and take control of their financial futures. This trend is reshaping the landscape of personal finance.

According to a 2024 survey by Schwab Modern Wealth, on average, younger generations begin investing as early as age 19. This certainly wasn’t a reality a couple of years ago. Because of this development, a number of students at this school have arrived at the extraordinary possibility of amassing wealth through the stock market.

Sophomore Grant Mu said he was able to achieve impressive growth on his real-life portfolio. His interest in investment began when he and his partner performed successfully at the DECA stock market game as freshmen.

“We were able to qualify for the International Career Development Conference (ICDC) through investing, which was a huge motivator for me to continue learning how to invest and apply it to real life,” Mu said.

But that type of investment at such a young age isn’t always easy. According to David Fronek, finance and investment teacher, it’s complicated to invest as a minor due to the fact that they are unable to hold an account in their name. What they have to do instead, is set up a shared account with a parent or guardian to ensure it’s maintained properly and has the necessary funding for transactions.

Despite these obstacles, there has still been an observable increase in youth participants. For Krishna Chouturi, youth investor and sophomore, DECA has been a helpful forum in which he can obtain assistance with his portfolio as well as improve his capabilities.

“I have gotten a lot of advice from people in DECA,” Chouturi said. “For example, I learned that it is important to diversify your portfolio. You can’t really invest only in one facet of business like medicine or AI or something like that. It is important to invest in a little bit of everything based on projections and other information.”

According to Fronek, in more modern times, teenagers and young investors have more access to information that could assist their investment process.

“The internet provides access to significantly more information and knowledge about how to invest and what investments are available,” Fronek said.

Mu said a critical step before investing is to research everything, that takes away many of the risk aspects. Research can involve taking both a micro approach by looking at the individual company, and knowledge of the macro landscape such as overall market sentiment and things of that nature.

“With social media there’s a lot more out there about investing, so it makes self-studying investing way easier. Everything is also more accessible, for example the process to get a youth account is really easy.”

Chouturi said he finds he is motivated by the success of his peers.

“Honestly, I think that investing is a relatively easy way to get a lot of money. Not to say it isn’t a lot of work because research is required and just overall knowledge of the economy. I’m inspired by all the success stories I hear, like younger people getting rich and more financially independent,” Chouturi said.

However, Fronek explained the issue with the motivation to “get rich quick.”

“One of the things I do in both my business course and my finance and investment course is run a stock simulation game where students have $100,000 of fake money to invest and they have to learn how to research stocks, get the right information, understand what stocks are and learn how to diversify their portfolio. I try to give them as much information as I can to help them understand the investment process, how it really works and what the risks and rewards of that are,” Fronek said.

Fronek said real-life mistakes can cost serious money when you’re investing with real money. Younger people tend to be a lot more risky when pursuing new acquisitions in their investments. They have more time to make up money they could potentially lose. You never know, they might get lucky and get a very good return.

Fronek also said he strongly believes that starting to invest at an early age carries huge benefits. Opportunity cost is the loss of potential gain. The sooner you put your money to work, he said, the better off you are. If your money is not doing anything, you’re actually losing it due to opportunity cost.

“One of the key principles of investing is called the time value of money,” Fronek said. “Let’s say you’re a high school student and you have $5,000 that’s just sitting in the savings account. Savings accounts pay very little interest. So if you invest $5,000 now and you’re getting 7% or 8% on that money, then in that investment you can double that money in five years.

Getting exposed to (financial literacy) early in high school is really benefiting students, he added, and getting them in a position where they at least have some knowledge of investing and how it can impact their lives.”

Mu said, “The topic of investment is starting to become quite attractive to younger people. Once people come to the realization that there are enormous advantages to investing, more financial literacy will be taught in schools, resulting in further opportunities for the youth.”

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)