By Ellie Seta

<[email protected]>

Senior Kiersten Walter has been forced to make a very hard decision, some of which is out of her hands. Walter, like most high school seniors, is beginning to narrow down her college choices. But more importantly, due to the latest economic crisis, she has had to add in a new deciding factor: money.

According to a study by the U.S. Education Department, the tuition for public universities in 2007 has risen 268 percent from 1977, causing many students to think twice about spending more money on their bachelor’s degree before they have steady job to pay off student loans.

“My number one choice is (Indiana University),” Walter said. “It just seems like the most logical for everything that I am looking for.”

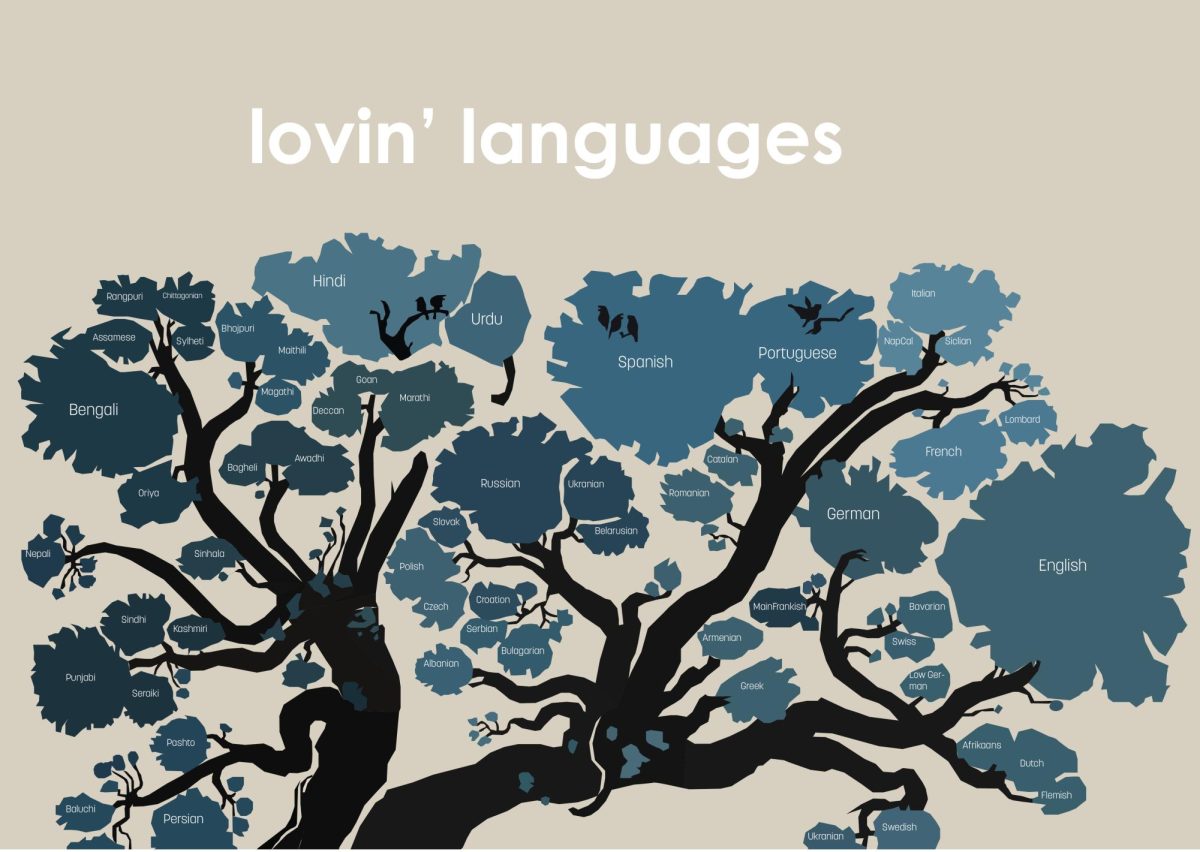

Walter, who is aspiring to major in elementary education, as well as a minor in both Spanish and contemporary dance, said that she did not really look at very many out of state colleges.

“My top choices right now are IU, Notre Dame and University of Michigan, “ Walter said. “Michigan was really the only out-of-state school I considered.”

But Walter said that in the end, IU has more advantages over University of Michigan and Notre Dame, especially affordability.

Counselor Bettina Cool said that she thinks going to a cheaper schol for one’s bachelors degree is a good idea in terms of saving money in order to have the money to go to a more elite school for their masters degree.

“I believe that with college getting more expensive and the economy not being strong it is the answer that makes sense,” Cool said. “I think it’s a fabulous idea.”

Senior Nick Cooper has also been experiencing the hard decisions that come with the college application process. Cooper who has applied to University of Pennsylvania, Massachusetts Institute of Technology and Georgetown University so far, has a slightly different outlook than Walter, who decided to choose the less expensive option.

“My motto is apply first, then worry about money second,” Cooper said.

Another problem that is causing many teens to fear is the reliance on scholarships, which are becoming more and more scarce due to the struggling economy. Walter said that since she is planning on going to IU, she will receive a lot of automatic scholarships that come with the advantages of attending a public university.

According to a study by College Board in 2004, 67 percent of high school graduates enroll in college. As a result, student grants are now only covering 39 percent of the costs of a four-year college.

“It is hard coming from Carmel because a lot are going to IU,” Walter said. “So it is important to have that special factor that sets you apart form the rest.”

Cooper also said that he is hoping to receive grant and scholarship money, but also fears that it might be more difficult due to the economy because they are becoming less available. However, he said that if you  have the capability, then the amount of money should not stop you from applying to a more expensive, elite school.

have the capability, then the amount of money should not stop you from applying to a more expensive, elite school.

“It is hard to believe, but sometimes Ivy League schools can be cheaper because of the amount of liberal scholarships given,” Cooper said.

But Cooper said that he is not completely ruling out in-state schools.

“It depends how much scholarships I am given,” Cooper said. “If I can pay less than $15,000, then I will probably stay in-state.”

Cooper said that overall, a master’s degree is the most important, so that is where he thinks the money should be spent.

As for Walter, she said that even though she is expected to pay for some of her college tuition, she said her parents will be helping her out financially.

“Ultimately, my plan is to get my bachelors degree for the least amount as possible,” Walter said. “Then get my masters at a more expensive school since I won’t have a lot of student debt, and I will have a job to support myself. But I really don’t see (the economy) getting any better, only worse.”

—

College Student Loan Debt

A recent study by the National Center for Education Statistics shows that about 50% of recent college graduates have student loans, with an average student loan debt of $10,000. The average cost of college increases at twice the rate of inflation; the College Board estimates that public school costs an average of about $13,000 a year and private schools costs $28,000.

STUDENTDOC.COM / SOURCE

![Review: “Suits” is a perfect blend of legal drama and humor [MUSE]](https://hilite.org/wp-content/uploads/2024/04/unnamed-1.png)

![Chelsea Meng on her Instagram-run bracelet shop [Biz Buzz]](https://hilite.org/wp-content/uploads/2024/04/IMG_2446-1200x838.jpg)

![Review: Quiet on Set: The Dark Side of Kids TV is the long awaited exposé of pedophilia within the children’s entertainment industry [MUSE]](https://hilite.org/wp-content/uploads/2024/04/unnamed.jpg)

![Review: “The Iron Claw” cannot get enough praise [MUSE]](https://hilite.org/wp-content/uploads/2024/04/unnamed.png)

![Review: “The Bear” sets an unbelievably high bar for future comedy shows [MUSE]](https://hilite.org/wp-content/uploads/2024/03/unnamed.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: When I Fly Towards You, cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: Ladybug & Cat Noir: The Movie, departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: Hidden Love is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: Heartstopper is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)

![Review: Ladybug & Cat Noir: The Movie, departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster-221x300.jpg)

![Review: Next in Fashion season two survives changes, becomes a valuable pop culture artifact [MUSE]](https://hilite.org/wp-content/uploads/2023/03/Screen-Shot-2023-03-09-at-11.05.05-AM-300x214.png)

![Review: Is The Stormlight Archive worth it? [MUSE]](https://hilite.org/wp-content/uploads/2023/10/unnamed-1-184x300.png)