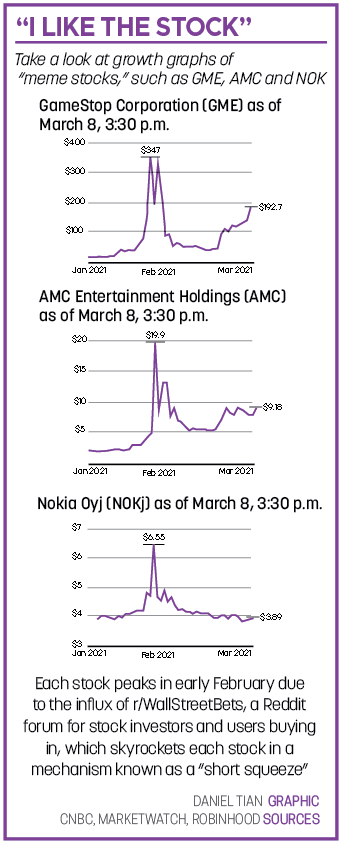

Last month’s buzz associated with GameStop and AMC and their stocks has died down for now, but for a moment it felt like everyone was glued to their phones tracking these two stocks. Of these people, a subsection was inspired from what they saw on the news to start investing. These people were inexperienced and new to the stock market, and while it’s amazing to see new people joining and getting involved in this money-making industry, it just might not have been the best nor the right time to do so.

Stocks like GME (GameStop Corporation) are incredibly volatile, and it was outright dangerous for people to invest. While seeing their stock prices spike up hundreds of percentage points made the stock incredibly attractive, it was obvious this was unsustainable and the stock crash was inevitable. This is exactly what happened, and when the stock market reopened the following Monday, hundreds of thousands of people saw heavy losses.

I do sympathize for those who lost money. GameStop’s stock looked like it was going to continue to rise, and it would have been impossible to predict Robinhood and other brokerages would limit the purchase of GameStop’s shares. With that said, many people made outright horrible investment decisions. When you invest you should never put the majority of your money into one stock, yet with GameStop many people invested their life savings under the impression they would get their money back and more.

I do sympathize for those who lost money. GameStop’s stock looked like it was going to continue to rise, and it would have been impossible to predict Robinhood and other brokerages would limit the purchase of GameStop’s shares. With that said, many people made outright horrible investment decisions. When you invest you should never put the majority of your money into one stock, yet with GameStop many people invested their life savings under the impression they would get their money back and more.

This investment with no risk assessment may have been caused by influencers. People saw influencers investing in these companies and thought to themselves, “Why shouldn’t I invest as well?” Influencers must realize that they have great power over the general public. What happened with GameStop illustrates that when it comes to investing, it is important to get your advice from credible sources and not from the first person you see on your feed.

Moving forward, as an investor myself, I recommend those who are new to the stock market industry to invest small amounts of money at first and consult resources such as Yahoo Finance and Investopedia when making their financial decisions.

Hopefully, what happened with GameStop reminds the public that the stock market isn’t a trend, and that people can lose thousands of dollars within the blink of an eye. The shorting that happened with GameStop and AMC isn’t a fluke and is bound to happen again in the future. I just hope when it does, thousands of people do not lose their retirement money like they did with GameStop and AMC that they worked so hard to earn.

The views in this column do not necessarily reflect the views of the HiLite staff. Reach Raghav Sriram at rsriram@hilite.org

View more of Raghav’s work here.

![What happened to theater etiquette? [opinion]](https://hilite.org/wp-content/uploads/2025/04/Entertainment-Perspective-Cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)