For senior Sara Standish, the financial aid system in America is unfair.

“Personally, I didn’t apply for financial aid because I wouldn’t receive any money. I feel like people in the middle (class) get screwed over because they can’t afford paying that much money for college,” Standish said. “For example, I got into Northeastern. Northeastern costs $80,000 a year, my parents aren’t (going) to drop 80k a year for me to go to Northeastern. But I also don’t qualify for financial aid. There’s people in the (upper class) that can pay (for college tuition) and there are people in the (lower class) that can’t pay (tuition) at all, but the middle class become the victims.”

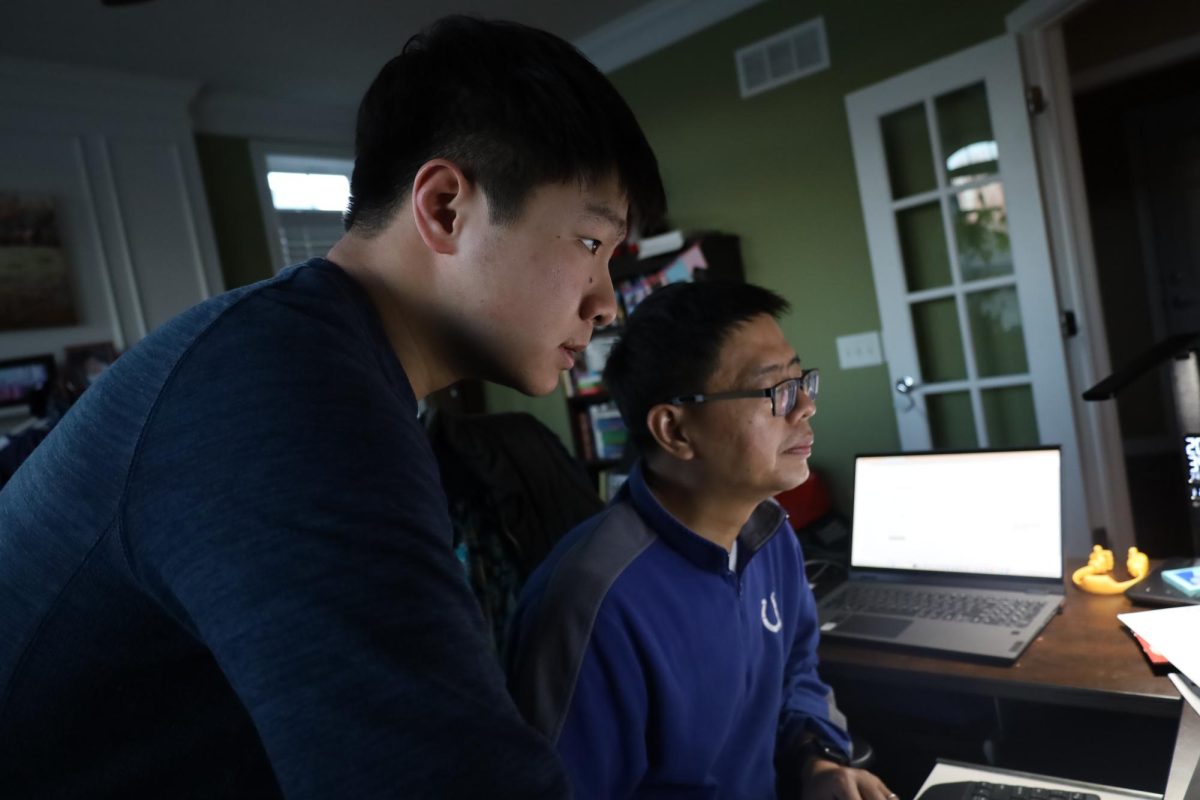

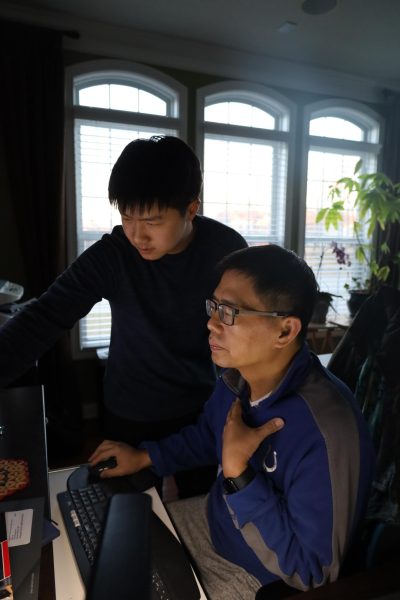

Senior Kevin Hu said he agrees with Standish and said the current financial system may underserve students with fewer resources.

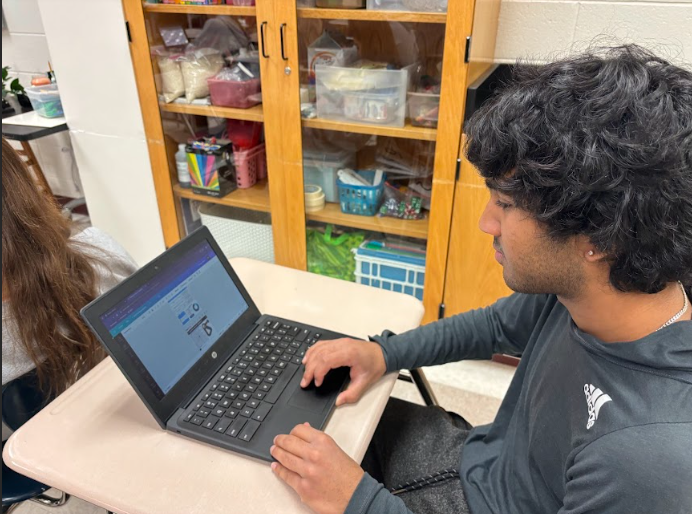

“I think that the current system tries to treat everyone equally and obviously students that need more money end up getting it,” Hu said. “But I do think that the process can be confusing, especially for students who need more resources. They might not always have someone to help them through the process, so I think they should make the process easier and make financial aid more accessible for everybody.”

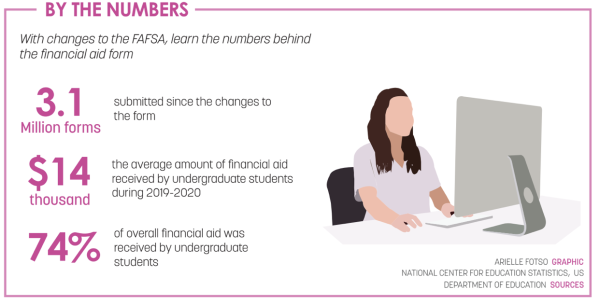

Standish and Hu aren’t alone in their concerns about the financial aid system in the USA. According to a 2023 study conducted by the U.S. Department of Education, only 45% of high school students applied for collegiate financial aid, which is a stark drop from the 52.1% of high school students who applied in 2022. College Raptor, a leading college consulting firm, attributes this decline to a lack of financial aid awareness, the difficulty of the FAFSA and students believing that they are ineligible for financial aid.

New Financial Aid System

CHS College Coordinator Melinda Stephan said the financial aid process was especially complicated this year and had many problems that could hurt a student’s chances of getting financial aid.

“Every college has different scholarship processes, different deadlines, different requirements and expectations. This year, the financial aid process was particularly difficult as the federal government rolled out a new FAFSA that was supposed to be easier. I completed it myself for my youngest, who’s a senior in high school. It was shorter and had easier questions,” Stephan said. “The problem this year was the late rollout. It was supposed to open on Oct. 1, but it didn’t come out until Dec. 30, so that means families across the country had less time to get it done. I also think some of the changes are a little bit clunky and have created issues they didn’t anticipate. They also apparently miscalculated the Pell Grant formula when they made the new FAFSA, which is part of the reason they’re hanging onto people’s data and not giving the data to colleges yet. So you have a miscalculation that is going to leave fewer students with money that they need/qualify for, and none of your financial aid data is going to colleges, which means colleges have less time to put together financial aid packages for students.”

Changes Needed to Financial Aid System

Standish also said she sees many problems with America’s financial aid system, and said she wishes college tuition in general would be remedied to be more equitable for people.

“The financial aid system isn’t super fair but that isn’t entirely their fault. I really think there should be more mandates or price controls of college institutions, like I don’t think (The University of Chicago) should be allowed to charge $93,000 a year, that’s crazy,” Standish said. ‘Even though people of a lower (socioeconomic) background might go to school for free or have cheaper education, more elite schools typically accept people who can pay the full price and they get away with (that system).”

Hu said he appreciates the changes FAFSA is trying to make, but wishes they made scholarships more accessible and simplified the financial aid process more.

“I know just from last year to this year, they simplified the FAFSA, they made it a lot shorter. One thing I would like changed is regarding scholarships. I feel like it’s kind of hard to look for them. It’s even harder for students who have little experience with the college financial process. Like for me, my parents went to college in China, so they aren’t super familiar with the process,” Hu said. “I think if there was a single site that maybe the College Board or Common App worked with, where students could input their information and find out what scholarships they are eligible for, the scholarship process would be much smoother.”

Financial Aid Resources Available For Students

Stephan said there are many resources at CHS to help navigate the complicated financial aid and scholarship process.

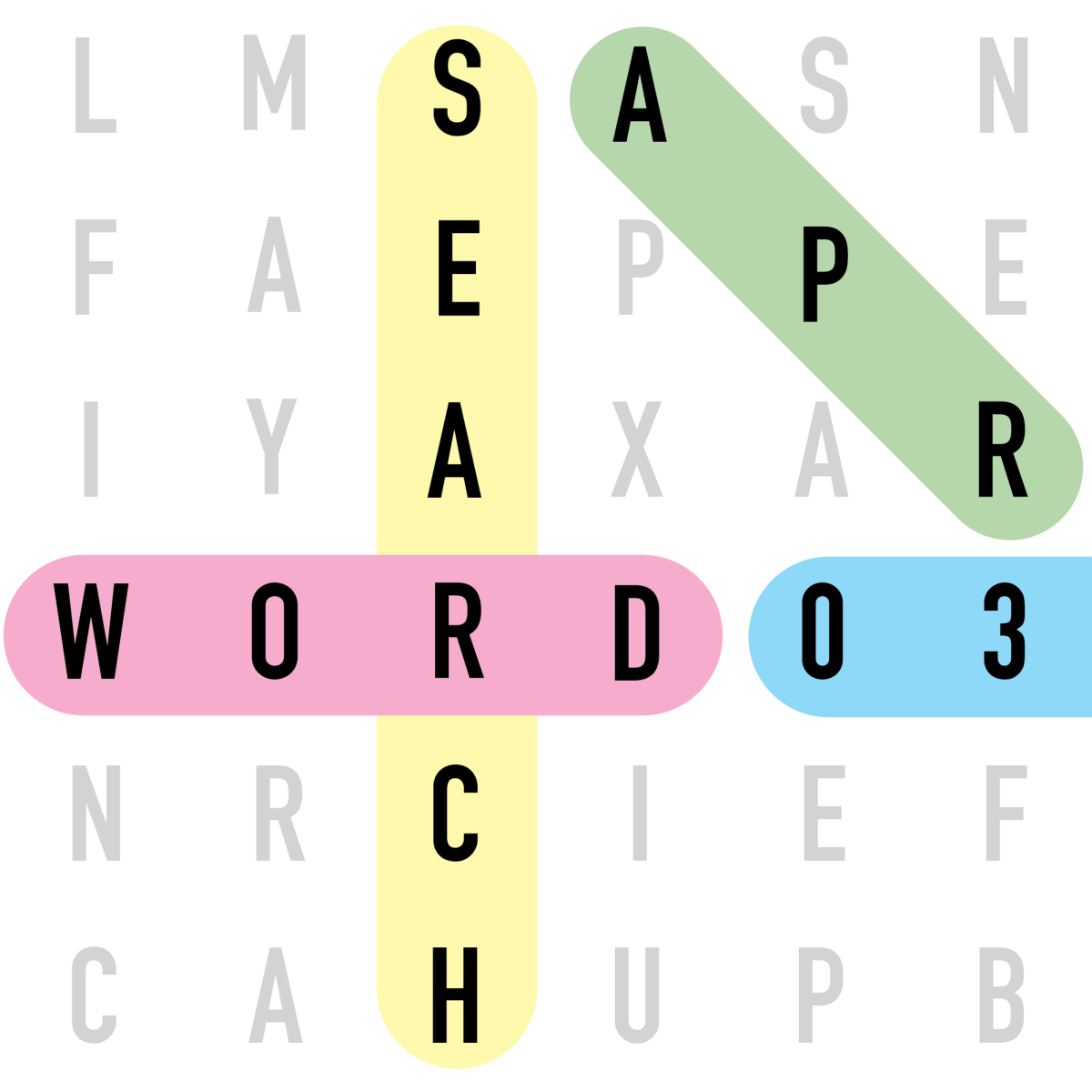

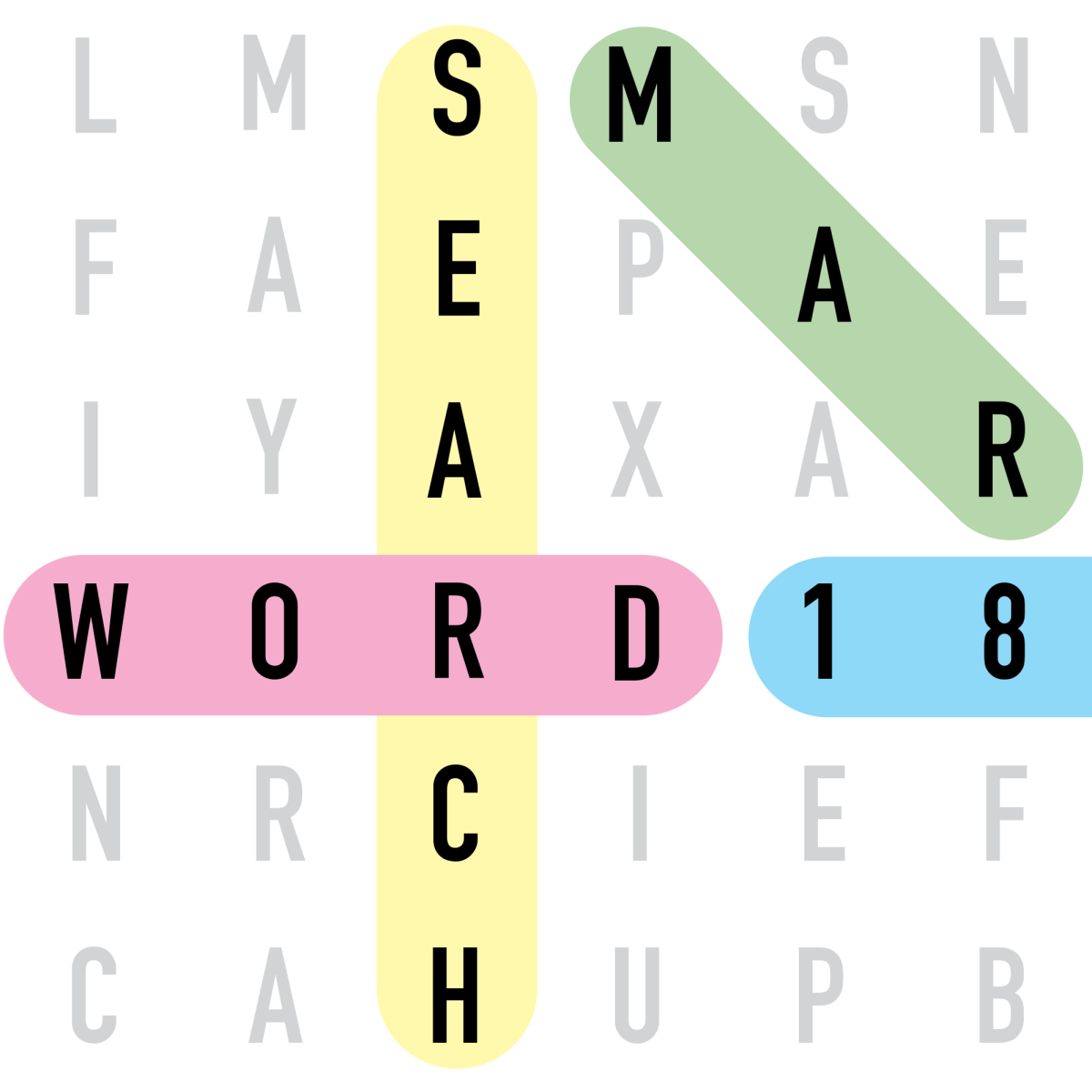

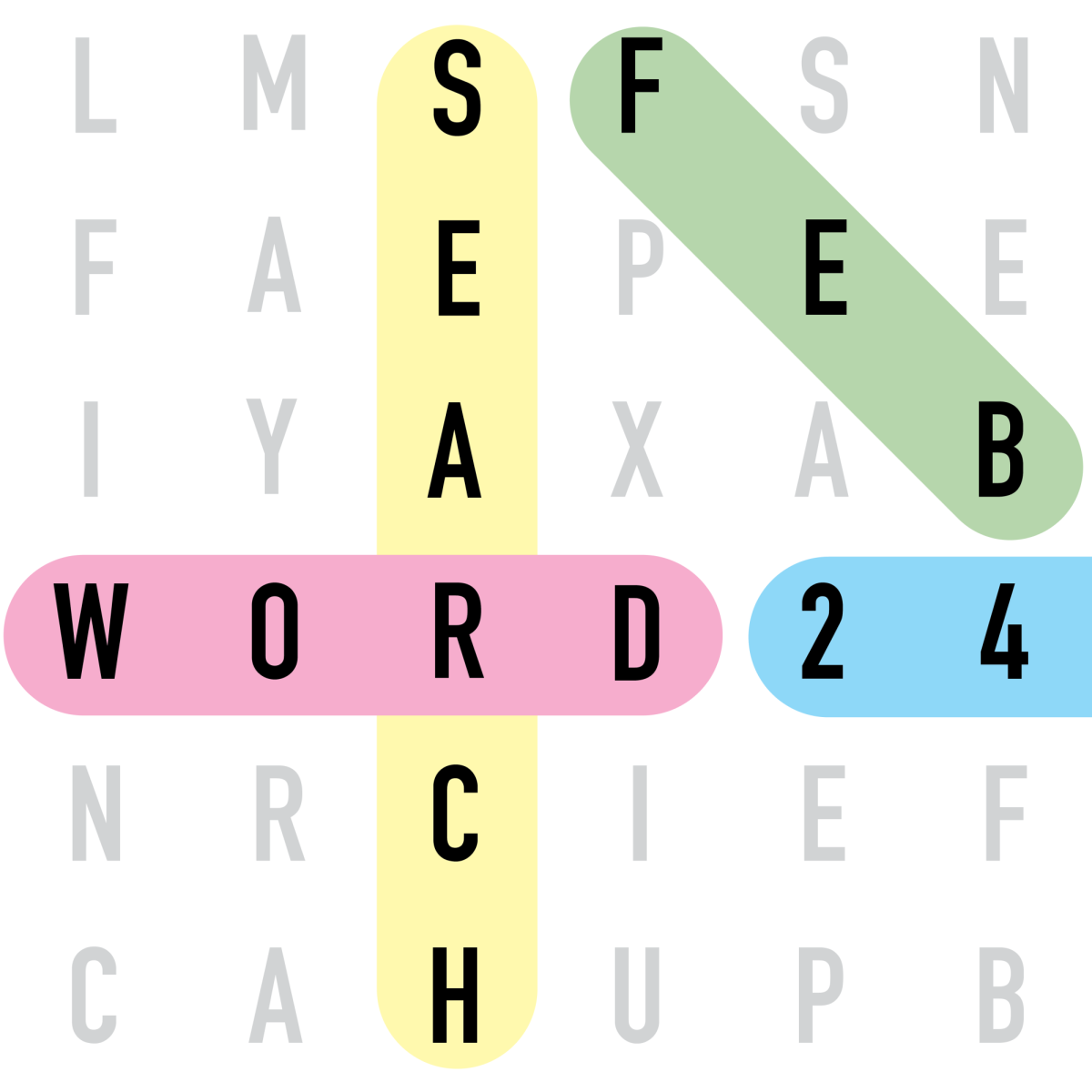

“We partner with an organization called INvestEd Indiana, they are an amazing non-profit organization that travels the state to help families and schools navigate the financial aid process. We bring them in several times throughout the year, they do a breakout session at the Junior/Senior College Information Night in September, they do a Financial Aid Night in October and do a FAFSA completion event,” Stephan said. “Just this last Tuesday we did a FAFSA completion event where we had 30+ families come and get help with the FAFSA. We promote College Goal Sunday, which is a week from this Sunday (Feb. 25); it’s a state-wide FAFSA completion event where families can go get help with the FAFSA. The closest location this year is Westfield High School.”

In addition, Stephan said she helps students one-on-one with the financial process.

“We do a lot of individual helping. I’ve helped several students whose parents were for one reason or another unable or even unwilling in some cases to help them with the FAFSA,” Stephan said. “We sit down and get them as far as we can. So there’s that kind of individual assistance as well if students want more personalized college advice.”

In light of Financial Awareness Month, Standish said she appreciates the current efforts CHS is making to educate people about financial aid, but wishes financial literacy was taught earlier and more intensively.

“I know we have a ton of resources about college finances at CHS, but a lot of people don’t try to use these resources to their fullest potential. I think the biggest thing that would help with this is more financial literacy around paying for college,” Standish said. “People don’t tend to understand the consequences of a student loan or (other financial aid options) and what that means for you financially. If we drilled into students how to take care of their finances from an earlier age, more people would make educated choices around college finances.”

![AI in films like "The Brutalist" is convenient, but shouldn’t take priority [opinion]](https://hilite.org/wp-content/uploads/2025/02/catherine-cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)