Senior Meredith Wettersten logs on to her computer, makes a few clicks with the mouse and quickly begins typing. Senior Mitchell “Mitch” Sobek suits up in his U.S. Army uniform, puts on his heavy boots and adjusts his cap. They’re two very different people in very different settings under very different conditions, but both have one thing in common—through their actions, they’re paying for college.

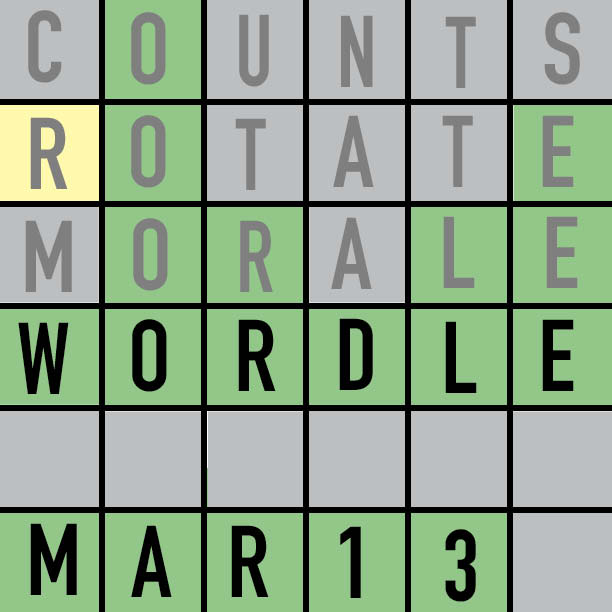

As Wettersten and Sobek try to combat increasing tuition costs, they are among thousands of other high school students across the United States who feel the squeeze. According to a survey released Jan. 10 by the credit ratings agency Moody’s Investors Service, nearly half of all the schools surveyed (165 nonprofit private universities and 127 four-year public universities) said they expect to see a decline in enrollment for full-time students, and one-third of the schools expect tuition revenue to decline as well, something many attribute to the increase in students’ difficulty paying for higher education. Furthermore, the upcoming budget negotiations in Congress may force more cuts in student aid programs, especially as more students rely on government loans and scholarships.

As financial aid and college acceptance deadlines loom, the painstaking process of figuring out how students, or their parents, are going to afford the collegiate price tag often serves up an intense dose of reality.

Linda Christy, College and Career Resource Center coordinator, said she understands these students’ predicament.

“College is not a cheap investment, it’s simply not,” Christy said. “But there are ways that every single student, no matter the circumstances, can make it possible. We work with students in a variety of ways to teach them about college readiness and answer any question they might have.”Lowering the cost of college has become increasingly vital for students, even after university. According to The Wall Street Journal, the class of 2011 was the most debt-laden class in the history of the United States, with the average grad leaving school $22,900 in debt—adjusted for inflation, that’s 47 percent more than it was just 10 years ago.

As higher education’s cost continues to spike every year, it’s doubtful that the current uptick in student loan debt will stop anytime soon. With this rise, students today are forced to become more and more creative in finding ways to cough up the cash without emptying their parents’ pockets or setting themselves up for decades of interest-racking loans.

Lowering the cost of college has become increasingly vital for students, even after university. According to The Wall Street Journal, the class of 2011 was the most debt-laden class in the history of the United States, with the average grad leaving school $22,900 in debt—adjusted for inflation, that’s 47 percent more than it was just 10 years ago.

As higher education’s cost continues to spike every year, it’s doubtful that the current uptick in student loan debt will stop anytime soon. With this rise, students today are forced to become more and more creative in finding ways to cough up the cash without emptying their parents’ pockets or setting themselves up for decades of interest-racking loans.

Weighing the Options

The three main routes students can take are scholarships (which can be merit-based or need-based), government-based aid through the filling out the Free Application for Federal Student Aid (FAFSA) and work-study programs on campus, Christy said. Wettersten takes part in these “typical” routes of paying for college.

“I have applied for a scholarship every Friday since August and will continue to do so until May,” Wettersten said. “It’s part of the AVID (Advancement Via Individual Determination) program that I’m in to get (students) ready for college. We have to send the report that says we entered in the scholarship to our teacher for a completion grade.”

AVID coordinator Shannon Woodson said the AVID program helps prepare students for college by investigating the college admissions process, locating the most appropriate school for each student, assisting them in writing college essays and finding recommendations.

“Helping students in AVID locate and secure scholarships to offset the cost of college has always been a part of the AVID curriculum,” Woodson said via email. “Students need to look at their future career options and the most affordable university for their desired major.”

Wettersten finds these scholarships online, through websites such as Zinch.com or Fastweb.com and can typically apply just by filling out her information, with the occasional essay requirement. While Wettersten has yet to win any of the scholarships she has applied for, Woodson said other students in the program have earned full tuition for public universities this school year. Wettersten’s mother, Kim Wettersten, said that most of the scholarship winners will not be announced until spring. With that in mind, Meredith said she is glad the AVID program requires that she apply for a scholarship every Friday.

“If I wasn’t being made to do this for a grade, I probably wouldn’t do it on my own,” Meredith said. “I’m glad AVID gives us the push and I think other seniors in the AVID program appreciate it as well.”

Meredith also said she plans to fill out the FAFSA and believes she will be granted federal money through that application. According to Mrs. Wettersten, Meredith has been offered some scholarship money from the universities she has been accepted to.

“All of the schools that she’s looking at are public schools. She did apply to two private schools and they offered her some scholarship money, but even that didn’t offset (the remaining cost) enough,” Mrs. Wettersten said.

Payment In Kind

Payment In Kind

While Meredith works hard to earn any extra money she can find to help her parents out, Sobek said he’s never considered applying for scholarships or taking out a loan—his college tuition has been paid in full since he joined the Army on June 26, 2012.

Sobek never wanted his parents to have to pay for his college education but also never knew how he could come up with the money on his own. Even after taking on a part-time summer job as a lifeguard for the past couple of years, his savings were nothing compared to what he needed to get his degree. Sobek was unsure of what to do, when the answer seemingly fell into his lap—the only catch? He may end up paying for his education with his life.

“I’ve wanted to join the Army my whole life. When the opportunity came up, I just took it,” Sobek said. “The fact that as a soldier my tuition to any public, in-state school is paid for 100 percent is just a bonus to me.”

“I actually found out that the military (pays for college tuition) when I was in the recruiter’s office talking about benefits. Up until that point I had no idea,” Sobek said. “I was happy, you know, because that’s just money that my parents can have back for their retirement fund or whatever.”

After starting classes at Ball State University in the fall of 2013, Sobek said he plans to graduate with a degree in organizational communications. Once he finishes college, he will then begin repaying the military for his education by committing to active duty. While there are different contracts he can sign based on his level of military involvement, from the National Guard to the Reserve Officers’ Training Corps (ROTC) to overseas deployment, Sobek plans to stay in the Army for eight to 10 years and work his way up the ranks.

“If doing this—defending your country—is not what’s in your heart, you definitely should not enlist just to get your college paid. Get a loan or a scholarship or do something. You won’t survive if you don’t love what you do,” Sobek said.

While Sobek’s choice may not be for everyone, Christy highlights the importance of looking for money in other uncommon places as well.

“Beyond those automatic, merit-based scholarships that colleges give, students can search for scholarships themselves. However, that is very time-consuming and can be very competitive. (These are) those ones where you really have to just listen to announcements and look at the websites. But that can range from, you know, an odd caddy scholarship to a health recreational major scholarship to an engineering scholarship,” Christy said. “All those different nuance things that are just not something you would automatically google and come up with. So it’s a lot of extra work on your part, but it’s worth it.”

Christy also said she recommends that all students take is to fill out the FAFSA. According to the Federal Student Aid website, the branch, which is an office of the U.S. Department of Education, offers over $150 billion in aid every year to help students fund their higher education goals.

However, many students here choose not to fill out the FAFSA, assuming they will not qualify for financial aid if their parents’ income is too high. Christy and Woodson both urge students to not follow that trend.

“Many scholarships,” Woodson said, “require this information even if students don’t qualify for aid.”

Christy also added that students should fill out the FAFSA in order to be prepared if a life-changing event occurs. The 2013-2014 school year deadline is midnight on March 10. Students can visit www.fafsa.ed.gov to find the required forms and paperwork.

“If there’s a loss of a job or a death in the family, colleges can go back and take that FAFSA and say, ‘Okay, you were able to pay full tuition this year, but because you had something happen, you can’t now,’ so they can make adjustments based on that situation if you file your FAFSA,” Christy said.

Making It Work

Still, despite all of the financial roadblocks that may stand in the way, college education may still pay off. According to a 2012 study conducted by the Pew Research Center, 86 percent of college graduates say their schooling has been a good investment.

Furthermore, the federal government and universities have both been working to make the dream of receiving a college diploma become a reality for all Americans. Some of these efforts may be seen in President Barack Obama’s new legislation to forgive outstanding student debts after 60 loan payments have been paid, as well as in Indiana University’s recently announced plan to freeze tuition costs for all students in “good academic standing” after the completion of their sophomore year.

There are infinite paths that students take to get through college, from the application process to the day when the final university bill is paid, a process that undoubtedly takes many years.

“You don’t have to be a straight-A student to go to college. You don’t have to be rich to go to college. You don’t have pay back student loans until you’re 80 to go to college,” Christy said. “There is a way for everyone.”

![What happened to theater etiquette? [opinion]](https://hilite.org/wp-content/uploads/2025/04/Entertainment-Perspective-Cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)