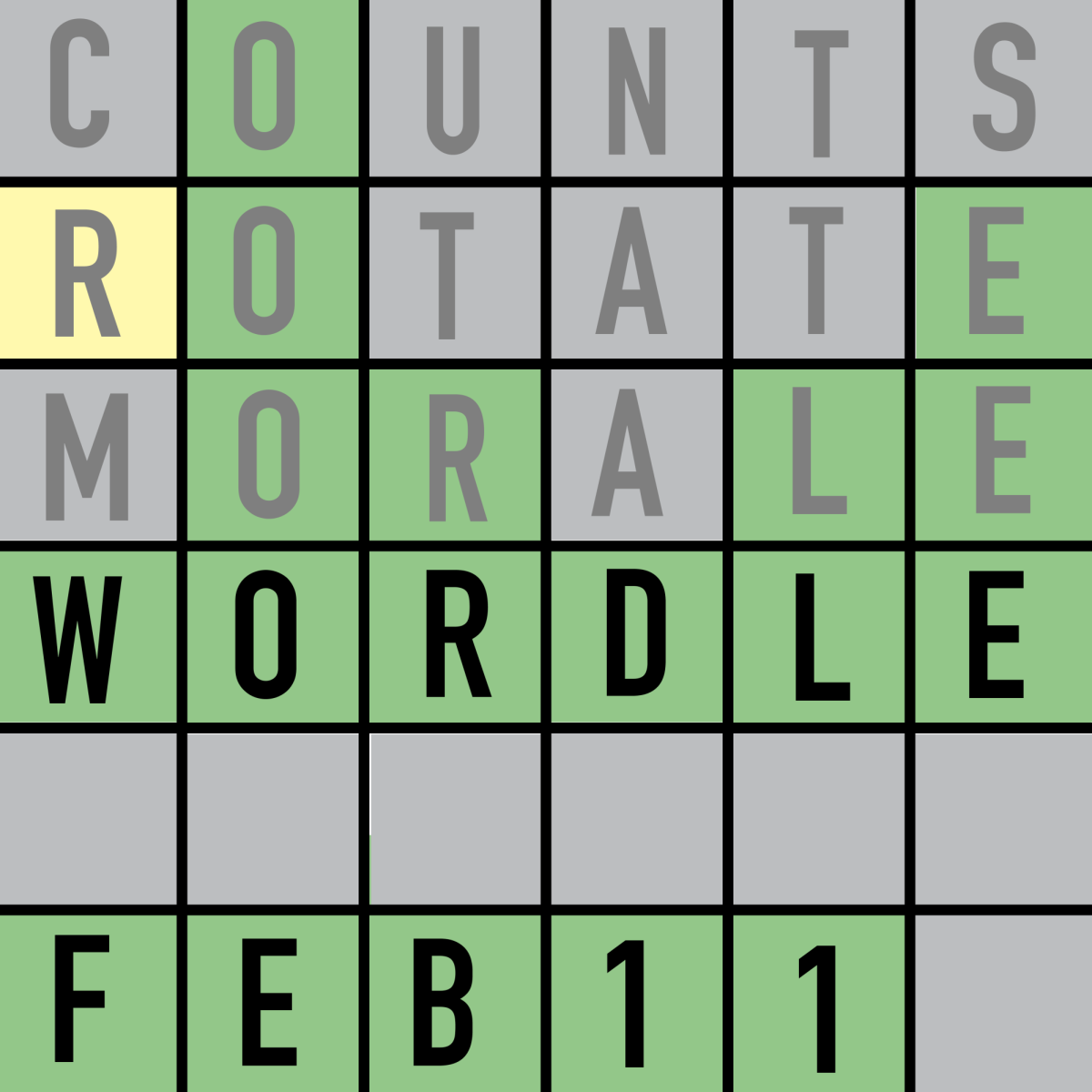

Due to the shift in state-sponsored school funding from property to sales tax and the recent recession, the source of revenue for the Carmel Clay School System has become unstable. In order to stop job losses and increased class sizes, the school board unanimously voted to adopt a $12 million Referendum Tax Levy Resolution at the Feb. 8 school board meeting.

In order to provide information on this topic, the school board has implemented a plan, involving the creation of a committee. Tricia Hackett, vice president of the school board, said via e-mail, “We will use a community-based committee for this effort since this is an issue effecting the entire community.” This group is known as the District Referendum Key Communicators Committee.

According to Superintendent Jeff Swensson, the committee is school board appointed. However, the committee will be in charge of recruiting volunteers, who will also help provide information to the public. He said, “We need lots and lots of volunteers to help out with spreading information explaining why we need a referendum and what might happen if (the tax isn’t implemented).

The committee will meet almost every other Thursday until the May 4 Primary Election Day. Voter registration deadline is April 5. By Sarah Sheafer <ssheafer@hilite.org>

![AI in films like "The Brutalist" is convenient, but shouldn’t take priority [opinion]](https://hilite.org/wp-content/uploads/2025/02/catherine-cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)

Mark Paul • Apr 29, 2010 at 1:22 pm

Excellence for our students and our community DOES depend on YOU —

This is a counterpoint to the Carmel Clay Schools (CCS) Home Owner’s Association “one-pager” released in late March 2010 to encourage affirmative votes on the upcoming May 4, 2010 $12 million referendum. It was prepared by Mark Paul, resident of Cool Creek Estates and father to two CCS students.

OVERVIEW

• The document distributed to members of Carmel Home Owners’ Associations in late March is intended to scare you into voting YES on the upcoming referendum. I’m asking you to vote NO so that we can all avoid paying additional, unnecessary taxes. Higher taxes are not the solution.

• Make no mistake about it, these are very tough times. We are in the middle of the worst global economic crisis since the Great Depression.

• Unemployment and underemployment is still higher than 10% and expected to stay high for several years and many families and companies have been forced to make drastic and across the board spending cuts – why should our public schools be any different?

EDUCATION IN CARMEL

• Carmel does have some of the best schools in Indiana and the residents of Carmel and employees of CCS should be applauded.

• The main reason students perform well in Carmel is because of the parents. Test scores are not correlated to higher spending per pupil. Carmel parents value education and demand excellence from their children, that’s why our kids are successful.

STATE OF INDIANA FACTS (from Governor Mitch Daniel’s speech to the Indianapolis Economic Club on March 18, 2010)

• Fifty percent of the state’s general fund expenditures are directed to K-12 schools

• 42 of the 50 states have cut K-12 expenditures in the past two years

• K-12 spending for 2010 in Indiana has been reduced by 3% statewide

• In comparison, 12 states have cut K-12 by 10% or more and 2 states by 20% or more

• Indiana’s K-12 spending for the past 10 years ranks third in the nation after adjusting for our lower cost of living

• Indiana ranks #8 in the nation on K-12 spending as a percent of personal income

• In Indiana, only 63% of K-12 expenditures make it to the classroom, versus 66% nationwide – we still spend too much on administration

• Regarding teacher’s salaries, Indiana ranks 21st in the country, but when adjusted for cost of living our teachers rank 7th

• From the start of 2008 until the start of 2009, the average Hoosier worker’s salary decreased by 2.4% while the average Hoosier teacher’s salary increased by 2.2%.

SOME THINGS TO CONSIDER

• CCS’ budget is supported by 7 funds – one, the general fund, is supported by statewide sales and income taxes, the other 6 are supported by property taxes

• While it is true that CCS receives fewer dollars per pupil than most other schools in the state, the allocation of monies to the general fund is based on a complex formula which takes into account test scores and other socioeconomic data – it costs more to educate kids who don’t have a supportive family structure. CCS receives less money from the State because our kids have high test scores due to the affluent, supportive families in Carmel.

• There is currently a $2 million referendum fund for CCS that continues until 2012 and CCS has included this $2 million in their $12 million shortfall, so they are double counting this money.

• There is $3 million of NEW spending in this proposal – do you honestly think now is the time for the government to be spending more money?

• The information CCS is using to encourage passage of the referendum has been misleading. In asking us to pay more in property tax, CCS used a bar graph to show that Clay Township has the lowest school property tax rates in Hamilton County. While this is true, they fail to mention that Clay Township has one of the highest assessed values in the state due to the large amount of commercial, industrial, and retail real property in Clay Township. So, even with a lower tax rate, CCS receives more actual dollars than the other school districts in Hamilton County.

• In addition, these property taxes are used not for the General Fund but are used primarily for debt service, transportation, and capital projects.

• CCS has also attempted to show that property taxes have gone down over the past several years on a $500,000 home in Carmel. While this is also true, the sales taxes we pay have gone up by 1% which has offset some of those savings for the average homeowner.

• CCS claims that the failure of the Referendum will result in declining property values. They cannot simply make this blanket statement. I think we will all agree that the roller coaster ride of property values over the past 10 years makes it impossible to predict what will happen to home prices. As long as parents remain committed to their children and their educational success, we will keep our community and schools vibrant and desirable.

• There is no guarantee CCS will not ask for additional referendum money if there are future shortfalls from the State.

• Hamilton Southeastern recently made over $4 million in cuts without releasing teachers.

• Zionsville Community Schools recently cut more than a million dollars from their operating costs after teachers agreed to salary and benefit reductions.

• The CCS administration seems unwilling to make cuts in their own budget. For instance, the Carmel Clay Teachers recently recommended that if the administrators paid the same percentage for health benefits as teachers, the system could save more than $600 thousand annually (per Indy Star article March 18, 2010).

• CCS provides luxuries such as projection and flat screen TVs in most classrooms that are not necessary for basic education.

• CCS teachers have a medical plan with a $250 family deductible – how much is your deductible? I’m guessing much higher.

• CCS is using our taxpayer dollars to print signs and buttons to encourage residents to vote YES on the referendum – they are spending money when they should be cutting costs

• CCS has attempted to silence opposition to the referendum by allowing only those in favor of the referendum to speak at school events.

• The lack of transparency on cuts and the misleading and irrelevant comments from the administration (such as tax rate comparisons) are of particular concern to this taxpayer.

• CCS has refused to allow a debate on the issue of the referendum on school property by not allowing the distribution of a counterpoint pamphlet to the one being handed out in the office of each school.

• CCS paid an executive search firm over $10,000 to find a new superintendent and he already worked for us.

• Ask the administration at CCS how they intend to spend the $12 million per year if the referendum does pass and you’ll get no clear answer or explanation.

• Why is the taxpayer subsidizing high school students to take advanced placement classes during the summer when summer school used to be to provide remedial assistance to challenged students?

SOME IDEAS TO SAVE MONEY

• Charge parents more for full-day kindergarten. This taxpayer paid about $6,000 to send his kids to full-day kindergarten at a parochial school prior to moving to Carmel.

• Charge for electives that have fewer than say 20 students.

• Eliminate the “late bus” and have parents pick up students who need to stay after school.

• Eliminate the new busing system that provides bus service to all students, even if they are within eyesight of the school.

• Eliminate the $7.4 million CCS plans to spend in 2011 and 2012 to upgrade things like flooring, sound enhancement, and the $3 million fitness facility – while it can be difficult to move money between the different accounting funds, it is not impossible – cash is cash after all and when has cash been as important as it is now.

• Take competitive bids for services such as employee benefits, property and casualty insurance, etc.

• Look at outsourcing certain functions such as custodial or lunch service.

Thanks for listening and please consider all of the facts before voting on May 4. It’s important to be informed on this important issue and I encourage you to go to the polls and make your voice heard.