Melinda Stephan, college and career programming coordinator

What is FAFSA?

FAFSA stands for Free Application for Federal Student Aid and it actually describes itself pretty well. It’s a free way to apply for financial aid from the federal government and state governments because when you submit the FAFSA, it also goes to the state and any financial aid potentially from colleges and universities.

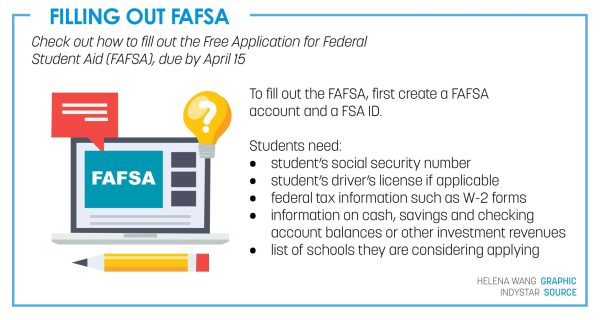

How do students submit for FAFSA?

It’s a free, online application. So [students] would have to go to studentaid.gov. There are multiple ways to get there, but that’s the easiest way to get there. This is where some of the changes come in. They essentially have a student part and a parent part, or they’re calling it this year “contributor,” but it’s typically the parent. They each fill out their part and hit “submit”. The whole point is that within the application, [students] will indicate which schools they want to send the FAFSA to. So when you fill out the FAFSA, the student’s going to list all the schools that they’re applying to, or considering going to. It’ll send that information and then if you’re admitted to that school, then that school, once they have the FAFSA information, will put together what they call a financial aid award for you.

What has changed for this FAFSA cycle?

The primary changes are that it is shorter, and so, in theory, easier to submit, fewer questions. It used to be that the FAFSA was one document and the student would fill in their part and the parent fill in their part and they could see both parts. Now it’s actually two separate parts. There’s a student part and a parent part. And technically you don’t see the other side. Now you can, if you’re sitting down with your parent filling it out and vice versa. So that’s a pretty decent change in terms of the experience, but really the whole idea behind it was supposed to be simpler and easier to submit.

At the end of the FAFSA, you used to get a number called an estimated family contribution.

That was loosely meant to say, “Our federal formula says your family should be able to contribute towards the cost of your education.” Then financial aid offices would use that number to make financial aid packages. There’s still a number at the end of the FAFSA now, but it’s called a student aid index.

Kind of does the same thing, but it’s a little less clear as to sort of the formula and how financial aid officers are going to use that student aid index. But I can tell you with great certainty that the lower the number of the student aid index, the more need you have, hence the more likely you’re going to qualify for financial aid.

So [the FSA ID] is a really important piece and that’s a part that we sent to all of our seniors because FAFSA didn’t open until Dec. 31. The one thing you could do before Dec. 31 was to create an FSA ID. It’s a fancy name for a username and password. So the student has to create an FSA ID. Then it creates the account for you. But then at least one parent has to get an FSA ID, I know that at a minimum. Then your situation dictates whether the other parent has to get an ID. The reason we were pushing out to our seniors to get it done early was in the past, you could create an FSA ID and then immediately start the FAFSA. With the new FAFSA, you have to create your FSA ID. It takes three to five days before you can start it. So we were trying to get our seniors and our parents to do this now. So when FAFSA does open, you can just jump on it.

Why are these changes implemented?

Basically, the motivation behind it was to make the FAFSA easier to submit and complete and to basically lessen the barriers to getting the aid that students might qualify for, to go to college. We want to take down barriers. Students who qualify for need-based aid to get help going to college should get it without having to jump through a lot of hoops. I think that eventually, that will be true.

They’re doing what they call a “soft rollout.” So they only had the FAFSA open at certain times during the day. Normally FAFSA is open 24/7. You could do it at 2 a.m. or you could do it at noon. But these first two weeks, they have been shutting it down for periods of time to make the fixes that they know are problems. So it hasn’t necessarily been simpler for everybody yet. But I think, ultimately, it will be easier for people to submit the FAFSA.

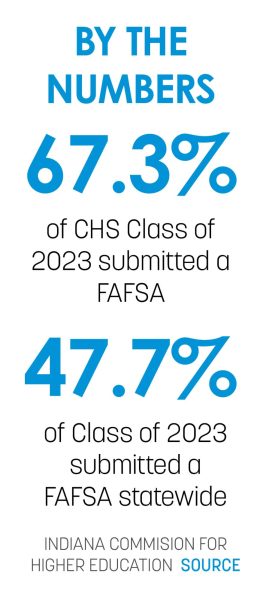

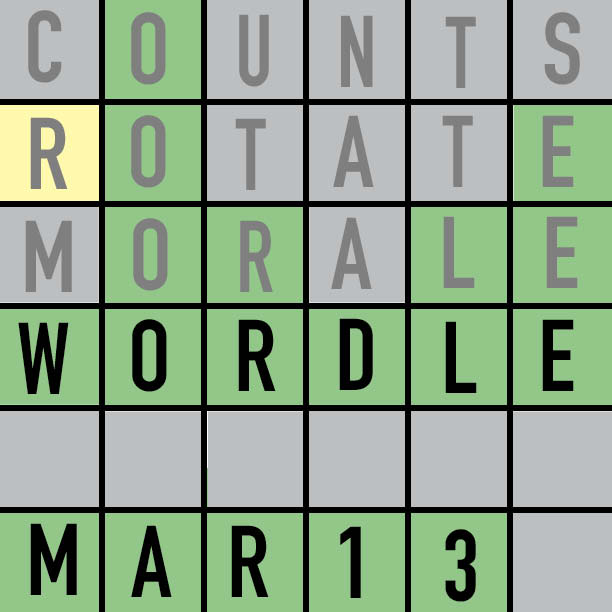

The state of Indiana this last year passed legislation that said that all high school seniors were required to file the FAFSA. And again, the motivation behind that was a lot of students don’t file the FAFSA that are missing out on aid that they probably qualify for. We’ve always encouraged every senior to fill out the FAFSA just to maximize their opportunities. It’s free. It normally doesn’t take more than about an hour as long as there are no glitches. At the very least, you’re eligible for low-interest loans. So it’s always been in their best interest and we’ve always communicated that. But with the new legislation, we have just had to be a little more intentional about really communicating with our families. Like even more communication about the benefits of submitting the FAFSA, letting them know there’s this law, letting them know the process if they decide not to fill out the FAFSA. We haven’t highlighted the opt-out process really heavily yet because we don’t want them to opt out. We want everybody to do it. At the end of January, we can pull a list of seniors that have submitted their FAFSA and we’ll follow up with those who haven’t and encourage them to do so and then maybe highlight the opt-out process a little bit. Then we’re going to follow up again at the end of February, end of March because it’s due April 15 in the state of Indiana. So we have a process in place to both encourage even more the completion of the FAFSA, but also to track completion and then encourage opt-out if they really are adamant. We’re all set up and there’s no repercussion for not doing so. But I think they wanted to put legislation in place that really encouraged completion of the FAFSA. So that’s what we’re doing.

How will these changes impact CHS students?

I’m not sure that it will have a real significant impact, negatively or positively. Most students are only a senior once. So the seniors now don’t know any different than the seniors before. I think this year, specifically, the impact is that things are a little messy with the FAFSA. I don’t expect that to continue into the future. I think they’ll figure out all the kinks and issues and get them fixed. And so next year, seniors will have a pretty easy go of it. So I don’t think the impact is going to be significant, other than maybe a little bit of stress and anxiety over the process. But we’re here to help. So we want to take some of the stress and anxiety away. We want to help people navigate and if we don’t know the answer, we have great resources.

How can students get help with the FAFSA?

Use all of the help resources that are within the FSA. So you can click on the little “i” next to each question. It’ll tell you how to answer that question. There’s help stuff within the FAFSA. [Students] can also reach out to me. We have resources. INvestED Indiana is a fantastic resource. They’re the people that we bring in for all of our financial aid programming, financial aid night, FAFSA completion night.

We are doing a FAFSA completion event on Feb. 13. So if [students] haven’t been able to submit before that date, we’ll be sending information out, probably in the next week or so. And they should have their FSA ID done [before the event].

![What happened to theater etiquette? [opinion]](https://hilite.org/wp-content/uploads/2025/04/Entertainment-Perspective-Cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)