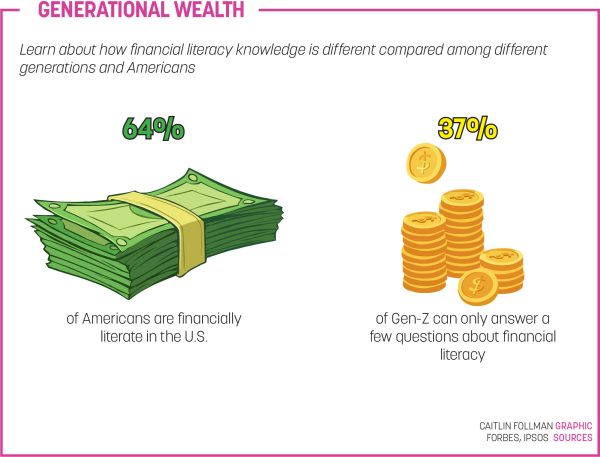

According to a 2023 study done by Ipsos, a French independent market research firm, about two thirds of Americans are financially literate. Financial literacy is the possession of skills and knowledge when making decisions regarding money. Those numbers of financially literate Americans, however, are dwindling. Baby boomers have a financial literacy rate of 55% in comparison to the 43% rate shown in Gen Z teens. Sophomore Taylor Zhang, who is enrolled in a personal finance class, said she was taking the course because she wants to know how to be financially stable.

“Growing up, I’ve been around a lot of places since my family has moved a lot and it’s really important to me that I know how to be financially independent and stable wherever I go, so that’s why I chose to enroll in a personal finance class even though I’m only a sophomore,” Zhang said.

Zhang said she thinks personal finance classes should be mandatory at this school.

Zhang said, “I just think learning how to make good financial decisions can be super beneficial and reduce the stress that might arise in someone’s adulthood and everyone should take the course (personal finances) at one point or another if they aren’t already taking a business or economics class.”

Personal finance teacher Stacie Phillips said although economics and personal finances as courses seem interchangeable in student minds, they are vastly different.

“Personal finance is so different,” Phillips said. “If everyone at CHS got a thousand dollars, where would that money go? But you would spend your thousand differently than I would. The way I spend it is personal finance. How we all spend the collective money is economics.”

Phillips said she would encourage students to take the personal finance class and, like Zhang, would want it to be required nationwide, like the economics classes.

“In all honesty, personal finance is more important. If we all took care of our bucket, then the economy would be strong as well because we’d all have the money to pay for a new well, or a new car, or that broken arm and it wouldn’t wreck us,” she said. “Like this December with the deep freeze that happened before Christmas, I had a rental property and the pipes froze and I had a week to come up with $15,000. Because I know where my money is going and I have a plan, all my bills still got paid. I was able to repair the well for $15,000 and I still went on vacation this summer. If I didn’t have a plan, the $15,000 would have wrecked me.”

While there are students who are enrolled in finance classes, there are many more students who have an interest in finances, but take them into their own hands.

Mikey Moehl, an active investor and junior, said he had piqued an interest in finances through social media. Without taking a finance class, Moehl said for the most part, parents who are financially literate are what determine the wealth disparities through generations.

“The higher class and more elite are the ones who are financially literate and stable and can pass it onto their children and usually less affluent families do not have much resources,” Moehl said. “That is where you get the idea of the rich getting richer and the poor getting poorer, the financial knowledge that parents pass onto their kids is what sets them up for their financial success in the future. I’m lucky enough to have a dad who is interested in investing and can show me how to read charts, but there are families out there who aren’t as privileged.”

Phillips said she struggled with having parents who were not as responsible with their money.

“My parents were the definition of how not to take care of your money. Everything I don’t want to do I learned from them. They filed for bankruptcy five or six times,” she said. “Babysitting, dog walking, lawn mowing, all at 12. I was already budgeting my money, paying for my own clothes and school lunches. I wanted a new bicycle so I saved up the money and bought that myself. For me it was really early because I could look at my parents and say no.”

In spite of a poor background, Phillips said she was able to resolve the gap in the financial knowledge her family lacked.

“It’s certainly possible for one to overcome family disadvantages. It just takes an extra step,” she said. “I definitely wish I had gotten the opportunity to take a personal finance class growing up or had someone there to better guide me, but that just goes to show how impactful having a more affluent household can be.”

Senior Miguel Ortiz-Perez, who took a personal finance class last year, said his family was lower middle class and for him, he is especially thankful to have had the financial knowledge to make decisions after what he learned.

“After receiving my first paycheck, I had already known what I was going to do with my money. I planned out how much would be saved, spent and invested. This would help me save for a trip to another country and even save up for a car,” Ortiz said. “Budgeting, which I learned in finance class, was definitely the most helpful and I hope to pass this knowledge on to friends and family in the future.”

![What happened to theater etiquette? [opinion]](https://hilite.org/wp-content/uploads/2025/04/Entertainment-Perspective-Cover-1200x471.jpg)

![Review: “The Immortal Soul Salvage Yard:” A criminally underrated poetry collection [MUSE]](https://hilite.org/wp-content/uploads/2025/03/71cju6TvqmL._AC_UF10001000_QL80_.jpg)

![Review: "Dog Man" is Unapologetically Chaotic [MUSE]](https://hilite.org/wp-content/uploads/2025/03/dogman-1200x700.jpg)

![Review: "Ne Zha 2": The WeChat family reunion I didn’t know I needed [MUSE]](https://hilite.org/wp-content/uploads/2025/03/unnamed-4.png)

![Review in Print: Maripaz Villar brings a delightfully unique style to the world of WEBTOON [MUSE]](https://hilite.org/wp-content/uploads/2023/12/maripazcover-1200x960.jpg)

![Review: “The Sword of Kaigen” is a masterpiece [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-201051.png)

![Review: Gateron Oil Kings, great linear switches, okay price [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-200553.png)

![Review: “A Haunting in Venice” is a significant improvement from other Agatha Christie adaptations [MUSE]](https://hilite.org/wp-content/uploads/2023/11/e7ee2938a6d422669771bce6d8088521.jpg)

![Review: A Thanksgiving story from elementary school, still just as interesting [MUSE]](https://hilite.org/wp-content/uploads/2023/11/Screenshot-2023-11-26-195514-987x1200.png)

![Review: "When I Fly Towards You", cute, uplifting youth drama [MUSE]](https://hilite.org/wp-content/uploads/2023/09/When-I-Fly-Towards-You-Chinese-drama.png)

![Postcards from Muse: Hawaii Travel Diary [MUSE]](https://hilite.org/wp-content/uploads/2023/09/My-project-1-1200x1200.jpg)

![Review: "Ladybug & Cat Noir: The Movie," departure from original show [MUSE]](https://hilite.org/wp-content/uploads/2023/09/Ladybug__Cat_Noir_-_The_Movie_poster.jpg)

![Review in Print: "Hidden Love" is the cute, uplifting drama everyone needs [MUSE]](https://hilite.org/wp-content/uploads/2023/09/hiddenlovecover-e1693597208225-1030x1200.png)

![Review in Print: "Heartstopper" is the heartwarming queer romance we all need [MUSE]](https://hilite.org/wp-content/uploads/2023/08/museheartstoppercover-1200x654.png)